Overnight, the Dow, S&P, and Nasdaq all saw modest gains, with 82% of S&P constituents closing in the green. The Eurozone CPI print was encouraging, which may have contributed to the gains.

On the global results front:

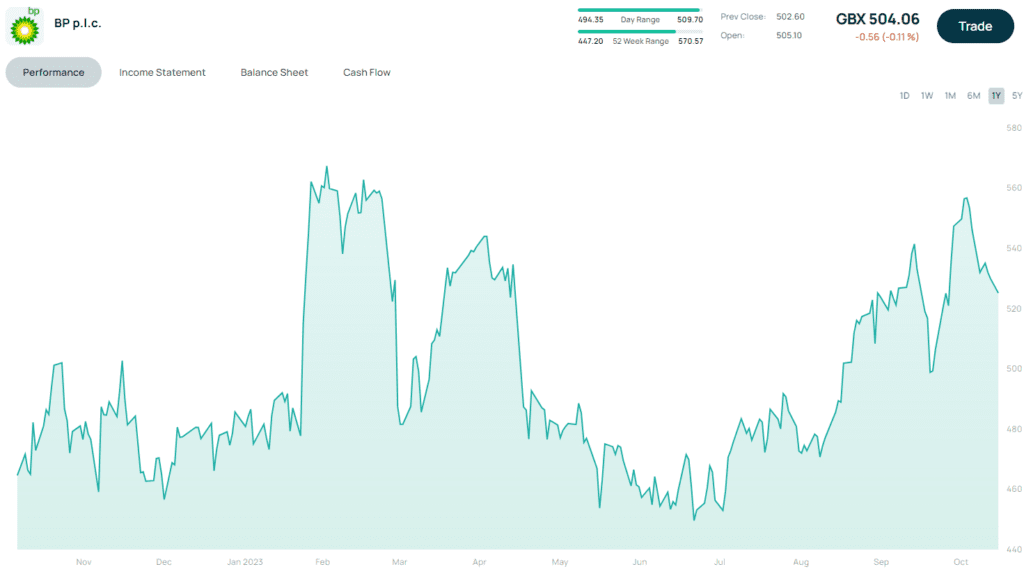

- BP‘s results were below last year’s record levels, while AB Inbev‘s buyback announcement was encouraging. Pfizer’s non-Covid portfolio is growing well, but the business is still trying to come to terms with a vaccine hangover as demand slows. Sysco’s numbers were a slight beat at EPS level, but there were signs of slowing sales growth.

- Caterpillar reported decent numbers, but the market was more focused on a shrinking order backlog.

- VF Corp pulled their FY guidance, and AMD’s numbers looked weak, but the market was tempered by management comments that their new AI-focused chip for cloud computing customers is going to generate $2bn in sales next quarter.

- Caesars provided further confirmation that the US consumer is in a decent space.

On the local front:

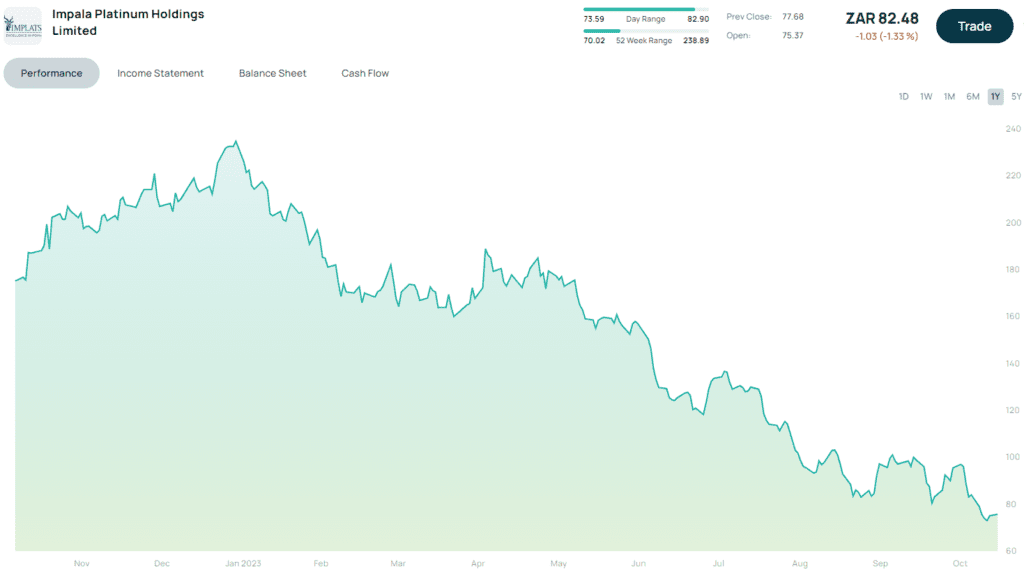

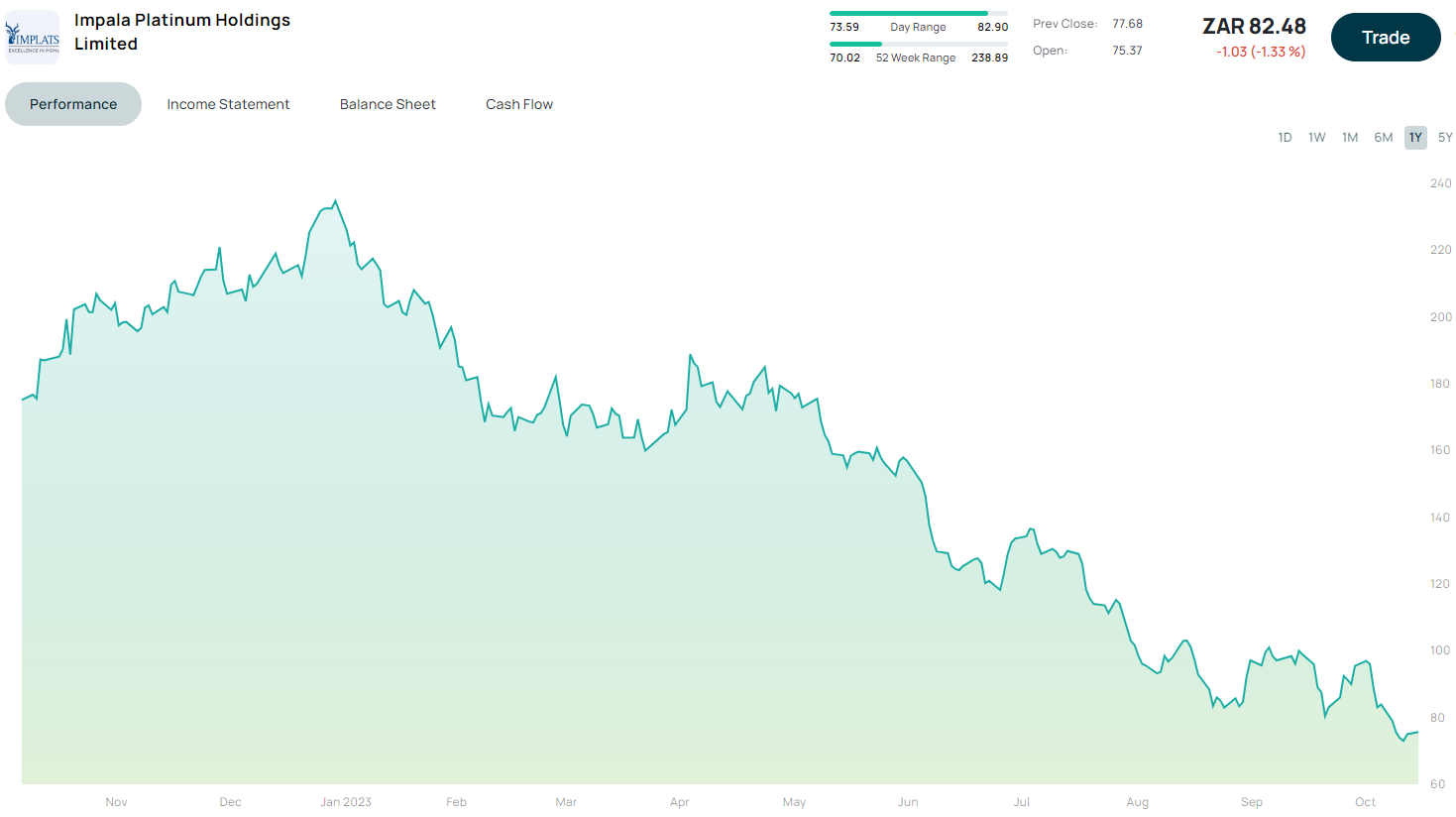

- Implats saw a price increase post yesterday’s production update, but there are questions about what will get the PGM market going against a very soft demand backdrop. There’s also uncertainty about AGOA, but many clients see this as a key catalyst.

- In Asia, the Nikkei saw gains while persistently weak Chinese data weighed on those markets. The BOJ’s actions are also unclear.

- The FOMC meeting is today, and while rates are almost certain to be held, it’s going to be about the forward guidance and how The Fed balances a strong domestic picture vs an increasingly worrying global one.