- Last night’s market session was uneventful after the US earnings season, and we await upcoming economic news (Dow flat, S&P +24bps and The Nasdaq +36bps).

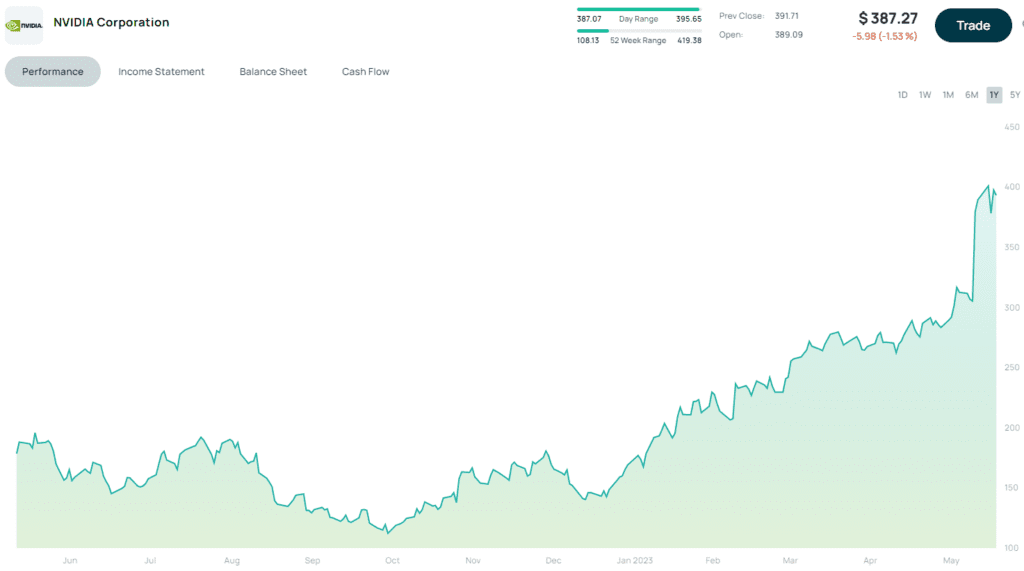

- Investors are showing interest in cyclical growth and value stocks, with AMD gaining (+5.3%) and Nvidia declining (-.1.3%).

- Apparel retailers saw gains (+4%), with regional banks (+5%) and apparel stocks rising.

- Homebuilders like Pulte and DR Horton reached all-time highs, indicating a strong US consumer market.

- Commodity markets posted small gains, but price action remains concerning, reflecting global demand dynamics.

- Topgolf Callaway rose 5% on news of a merger between LIV and the PGA, benefiting the global game of golf.

- Chinese exports fell, leading to expectations of government stimulus measures and an increase in the Hang Seng index.

- The Nikkei and ASX indices had mixed performance, with tech underperforming and consumer discretionary stocks showing strength.

- The South African Rand (ZAR) is trading within a narrow range, but some anticipate a potential decrease in value.

- Investors are considering ZAR hedge stocks to balance exposure to South African companies.