Stocks to Watch

Adidas, a major offshore earner, reported better-than-expected results this week. However, they also posted their first annual loss in over 30 years and warned of declining sales in North America due to high inventories at sportswear retailers.

Adidas expects improvement in their underlying business in 2024, with a projected growth of at least 10% in the second half. You can review Adidas’ Annual 2023 Report Dashboard at this link: Adidas Report Dashboard.

TFG Limited, also known as The Foschini Group, is a South African retail clothing group listed on the JSE. They operate under various brands and have a portfolio of over 3,000 stores.

TFG has signed a franchise agreement with JD Sports Fashion Plc, a global sports fashion retailer, to be their exclusive retail partner in South Africa.

According to David Smith, Equity Research Analyst of Investec, this partnership is seen as a defensive move to protect TFG’s dominant position in the athleisure market in South Africa, rather than a strategy to significantly increase their market share.

WeBuyCars – Transaction Capital

- Webuycars will commence with trade on the Johannesburg Stock Exchange (JSE) on Thursday, 11 April 2024 with plans to achieve a market capitalisation of between R8.7 billion and R10 billion.

- The company revealed this in its pre-listing statement, released yesterday as part of its preparations for listing on the JSE, by completing an unbundling process its owners Transaction Capital are hoping to unlock value for its shareholders.

- The investment holding company’s share price was adversely affected by dwindling fortunes in its SA Taxi division, which last year posted a R3.7 billion loss from continuing operations.

- The company reported a profit of R778 million in its latest annual results. At these profits and anticipated market cap, WeBuyCars would be listed at a P/E ratio of 11.18 to 12.86 and a price-to-sales ratio of between 0.43 and 0.5.

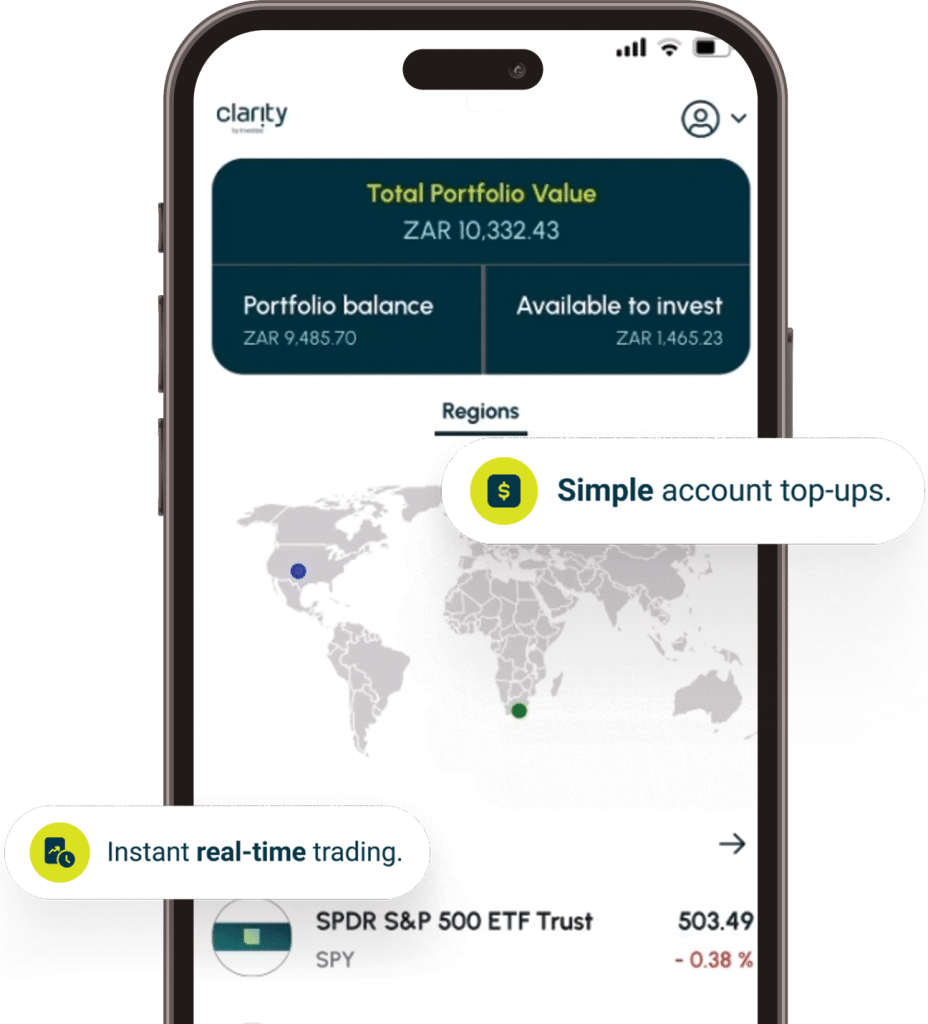

NEW! Trading Listings added To Clarity, by Investec:

Palo Alto Networks Inc

Shopify Inc

SoundHound AI Inc

What is leverage?

When you trade with leverage, you can take on a larger position without having to pay the full cost at the start. Say you wanted to open a position that was the same as buying 100 Netflix shares. With a regular trade, that would mean paying for the 100 shares in full right away. With a contract for difference, you might only have to pay 15% of the cost upfront.

You can spread your capital further by utilising leverage, but it’s important to remember that your profit or loss will still be based on the full size of your position. In our example, that would be the difference between the price of 100 Netflix shares from when you opened the trade, to the point when the trade closed. This means that both profits and losses can be much bigger than what you initially put in. Because of this, it’s important to keep an eye on the leverage ratio and make sure you’re not trading more than you can afford.

When you trade with leverage, you open a position with money you borrowed from the broker. As part of their investment strategy, traders may want to use leverage to get more exposure with less money on hand. Leverage is used in multiples of the trader’s capital, such as 2x, 5x, or more. Leverage can be used both to buy (go long) and to sell (go short). It’s important to remember that both profits and losses will be multiplied.

Join the conversation:

Remember, investing in the stock market carries risks, and past performance is not indicative of future results. It’s important to do thorough research and make informed decisions when diversifying your portfolio. Stock trading can offer the potential for high returns and the opportunity to diversify your portfolio across different sectors, providing liquidity. By investing via a Contract with Investec (CFD) you also take Investec Credit risk.