·

Market trends have been mostly

positive with sectors and S&P constituents closing higher.

·

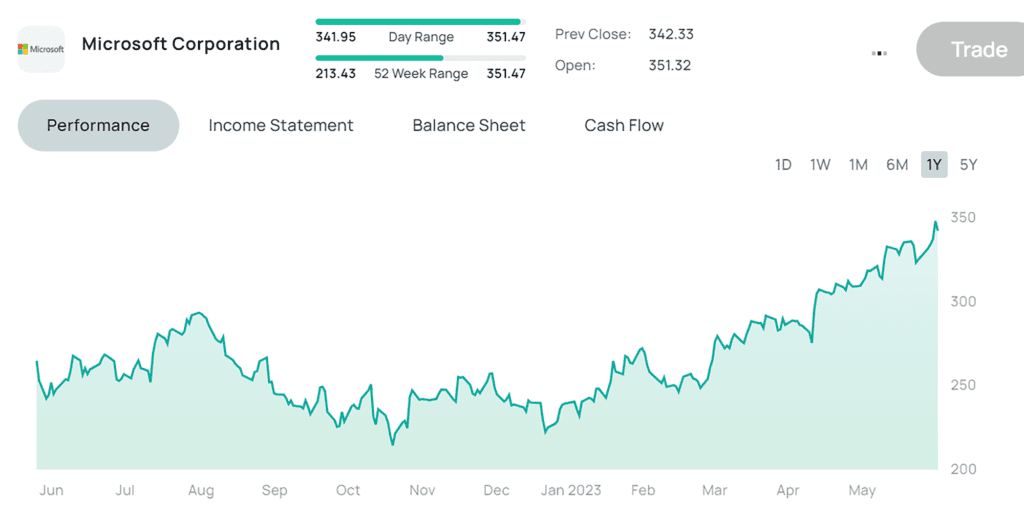

Tech stocks, like Microsoft,

reached new all-time highs.

- Some profit-taking observed in the semiconductor sector due to concerns about AI-driven frenzy.

- Commodity prices saw notable movements, with oil up 3.5%, natural gas up 9%, and agricultural products rising around 4%.

- Friday’s session saw a slight pullback, with yields increasing and equity markets closing with modest losses.

- Defensive sectors like utilities and staples performed well.

- Commodities remained strong, with oil up 1.5% and natural gas up 3.4%.

- Asian markets declined due to geopolitical factors and lack of stimulus news.

- South African markets experienced a positive “SA Inc rally” supported by surprises in loadshedding and news of hosting the BRICS summit.

- Consider the impact of South Africa’s foreign policy approach on economic stability.

- The government’s decision not to sell its Telkom stake and recent developments indicate a commitment to a developmental state.

- Overall, the SA Inc rally is expected to continue, but caution is advised with ratings and the longer-term narrative.