- The overall market has been strong, but it’s natural for it to take a breather after such a robust run. The Dow is slightly up, while the S&P and Nasdaq have dipped a bit.

- The S&P now trades at nearly 20 times its forward earnings, which is towards the higher end of its long-term range. The market has already priced in expectations of a soft landing.

- There’s been a downgrade of the US credit rating by Fitch due to the growing fiscal deficit. This may have implications for other credit ratings as well.

- Despite comments from the Fed’s Bostic that a rate hike in September isn’t necessary, treasuries were slightly weaker overnight. The US Dollar is rebounding, and industrial commodities like copper are under pressure.

- Several companies reported their results:

- BP saw lighter profits but offered a positive total return narrative with a growth in dividend yield and a buyback.

- Diageo had inline sales growth and earnings, increased dividends, and normalizing demand.

- Molson Coors outperformed peers with strong sales growth and margin expansion.

- Toyota achieved a new all-time high due to improving supply, weaker Yen, and strong product demand.

- Norwegian Cruises faced a sell-off as forward guidance disappointed despite strong revenue growth.

- Caterpillar delivered excellent results with increased revenue and margins, driven by healthy demand.

- Uber reported its first operating profit, but growth is slowing, particularly in their freight business.

- Altria showed improvement, with cigars growing in popularity, driven by a higher inflation environment.

- AMD experienced a post-market rise as its AI products gained significant customer interest.

- Starbucks missed revenue expectations in the US but saw strong growth in China.

- Match’s price increases at Tinder led to a clear revenue beat.

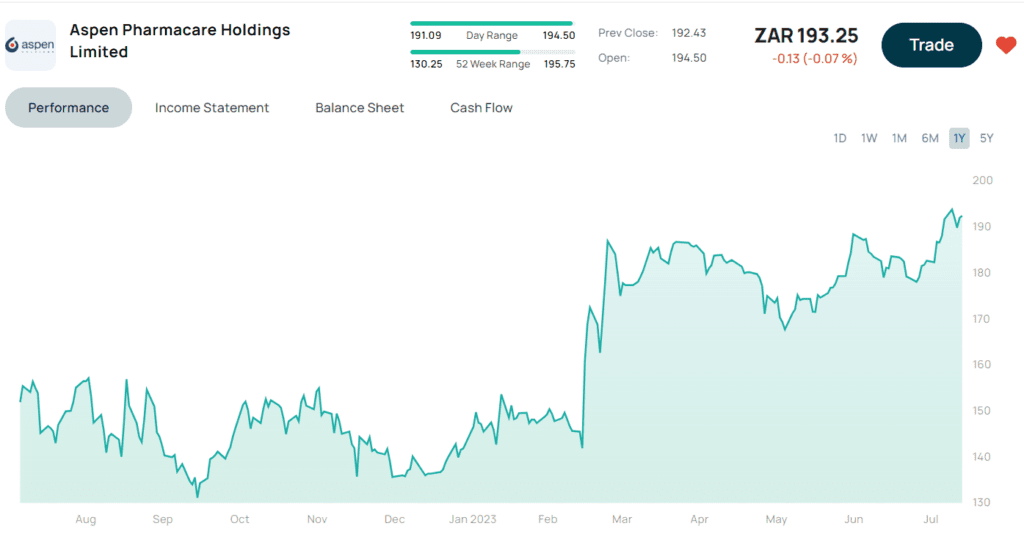

- Locally, Aspen announced a deal to acquire off-patent drugs, which surprised investors. AngloGold missed estimates due to a cost issue and industry-wide inflation. Textainer had solid Q2 results and its book value is increasing.