- Yesterday’s market saw weak results from Tesla and Netflix, causing a sell-off in tech and consumer discretionary sectors. Additionally, TSMC’s results triggered a decline in the semiconductor sector, leading to a significant outperformance of value stocks compared to growth stocks.

- The Dow Jones closed with modest gains, thanks to healthcare, financials, and energy sectors. On the other hand, the S&P and Nasdaq ended the day in the negative.

- Currency-wise, the dollar experienced some fluctuations, while yields remained slightly weaker.

- In terms of global results, Electrolux reported a surprise loss due to declining demand for consumer electronics and white goods, as consumers prioritize experiences and travel over purchases.

- TSMC’s results disappointed investors, with a projected 10% decline in sales for the year and weak AI chip demand, affecting semiconductor stocks like AMD and ASML.

- Philip Morris showed progress in shifting away from combustibles, but concerns arose over a third price increase for Marlboro impacting volumes.

- Speculation surrounds British American Tobacco potentially monetizing its stake in Indian conglomerate ITC, which has seen significant growth.

- American Airlines reported record revenues but fell short of market expectations for a larger upgrade, while United Airlines had a more optimistic outlook, creating uncertainty.

- The Blackstone Group experienced a decline in distributable earnings, but deals remain muted as buyers seek cheap assets while sellers hold on to higher valuations.

- On the local front, Angloplats in line with expectations, with solid metal production and sales forecasts intact.

- Kumba missed some expectations, but production and sales numbers exceeded forecasts. FY23 sales guidance remains at the mid-point of revised estimates.

- The MPC kept the benchmark rate unchanged. Short-term downside risks to inflation persist, surprising some investors in the ZAR and SA Inc.

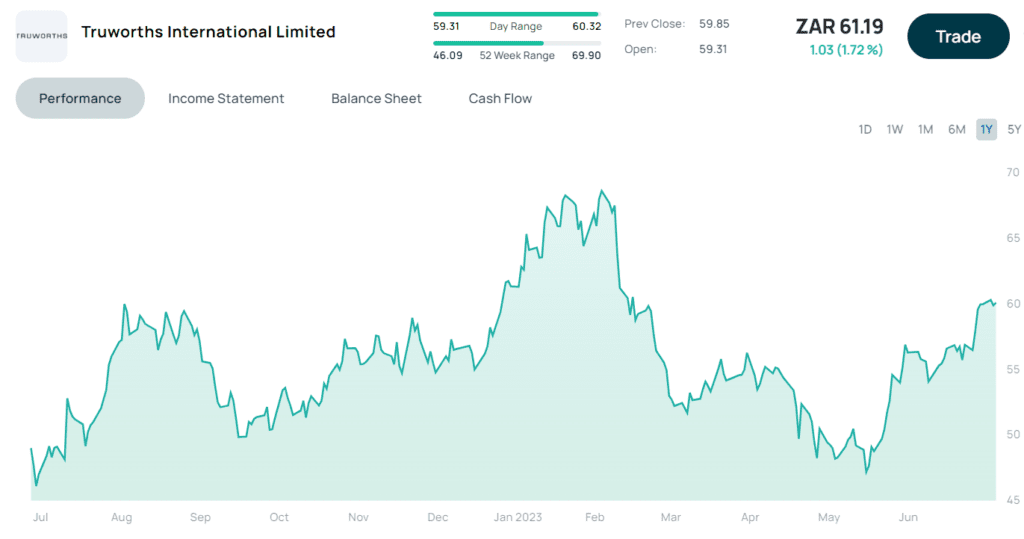

- Truworths showed overall sales growth, but a significant contrast between SA (slowing) and the UK (strong growth). Credit sales declined, impacting overall growth.

- Mr Price had a Weak June sales update, with retail sales showing minimal growth. Large inventory levels indicate potential markdowns affecting gross margins.

- Vodacom reported organic service revenue growth slightly above consensus, driven by strong performance in SA and Egypt, while other regions fell slightly short of expectations.

- Apart from results, Swiss watch exports showed solid growth, and France’s Canal+ Group acquired a stake in Swedish streamer Viaplay.