South African market sentiment:

- Market generally of the view that the geopolitical situation potentially won’t escalate

- A very uncertain macro environment means that people are looking for safe places to hide in an idea-scarce market

- Banks are still seen as a relatively safe place to hide

- Clients are still cautious about retail stocks, but we will be loading up the truck if global rates start to roll

- On the mining and energy front, clients agree with our bullish energy theme, but struggle with Sasol and Exxaro bottom up. M&A/poor capital allocation at the latter is the key concern

- Clients are more patient on improving rail volumes than we thought would be the case, and generally believe this will play out

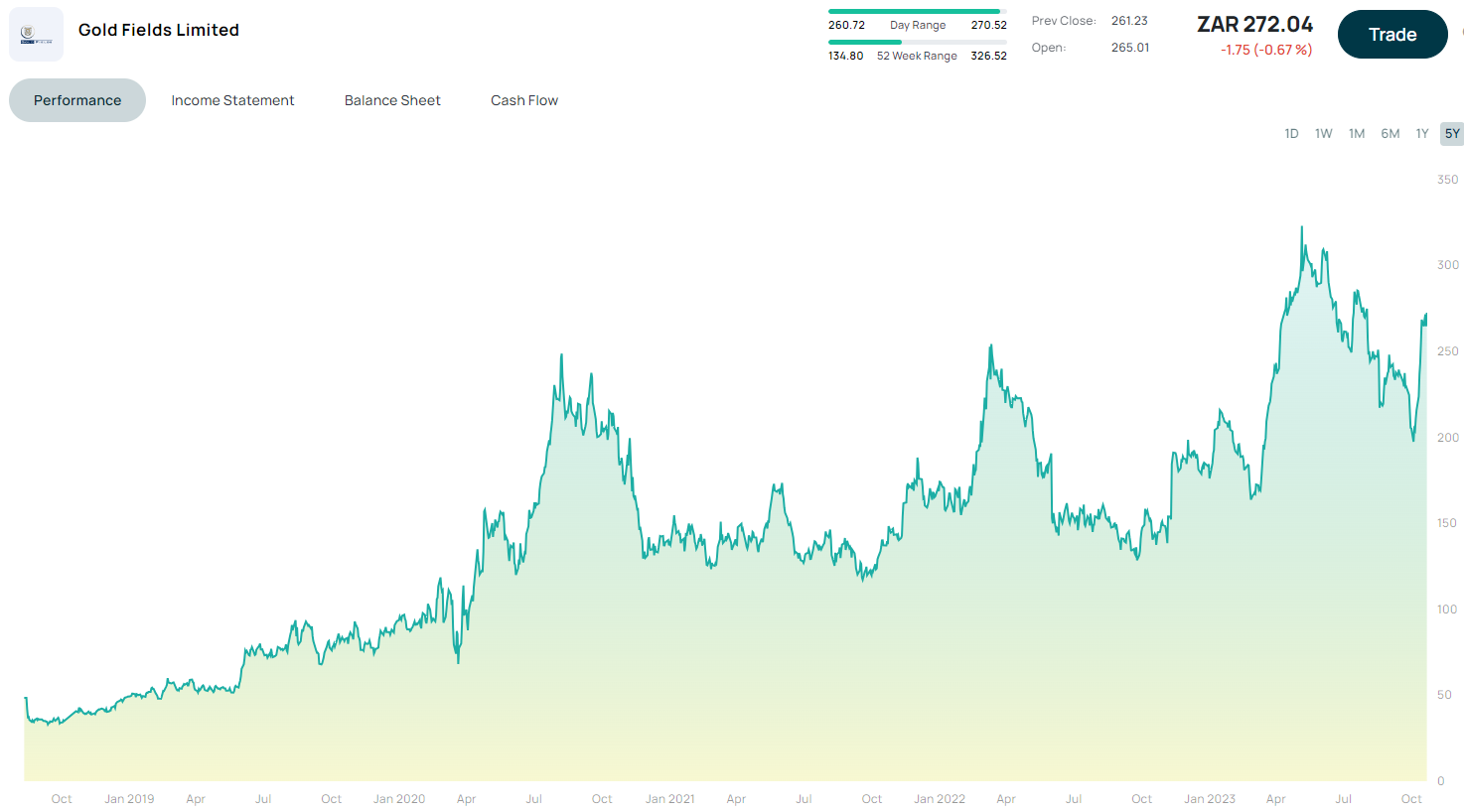

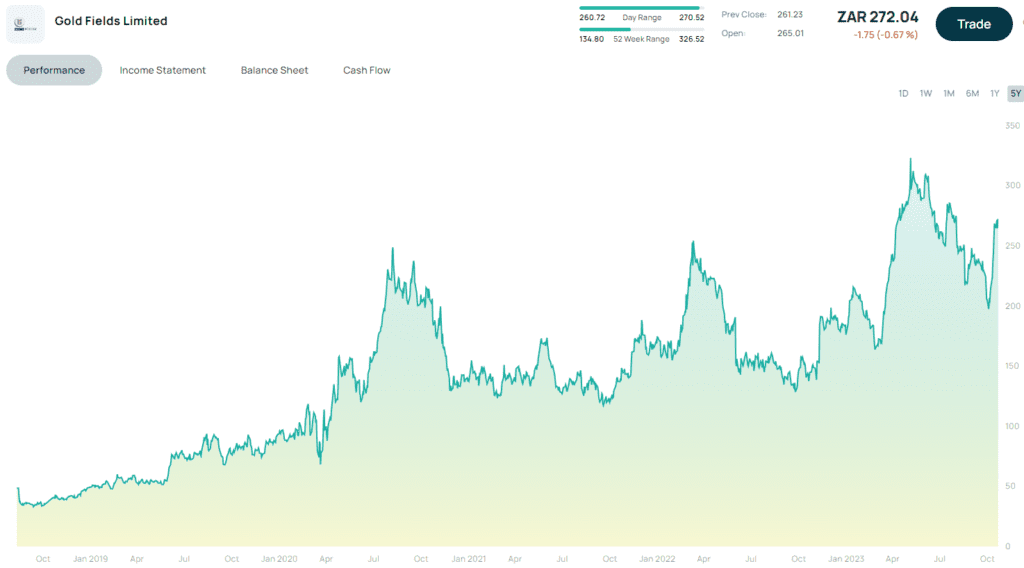

- SA investors are nervously underweighting the SA gold stocks and are looking for opportunities across the PGM’s (Platinum Group Metals)

- For those that want to address this, the bottom-up answer isn’t obvious, but we’re sticking with Gold Fields (GFI)

- The consensus view is that we’re going to see a decent supply-side response to depressed PGM prices, which will drive up prices and, in time, the stocks

- On the telco front, it’s clear that Vodacom and MTN look cheap, but we didn’t get a sense that investors are about to dive in

- Life Healthcare is definitively preferred when it comes to the hospitals

- Elevated bond yields continue to crowd out the property market, although there are clear signs of improving fundamentals

International market update:

- Major US benchmarks experienced a whipsaw session overnight

- Losses would have been bigger if it wasn’t for big tech

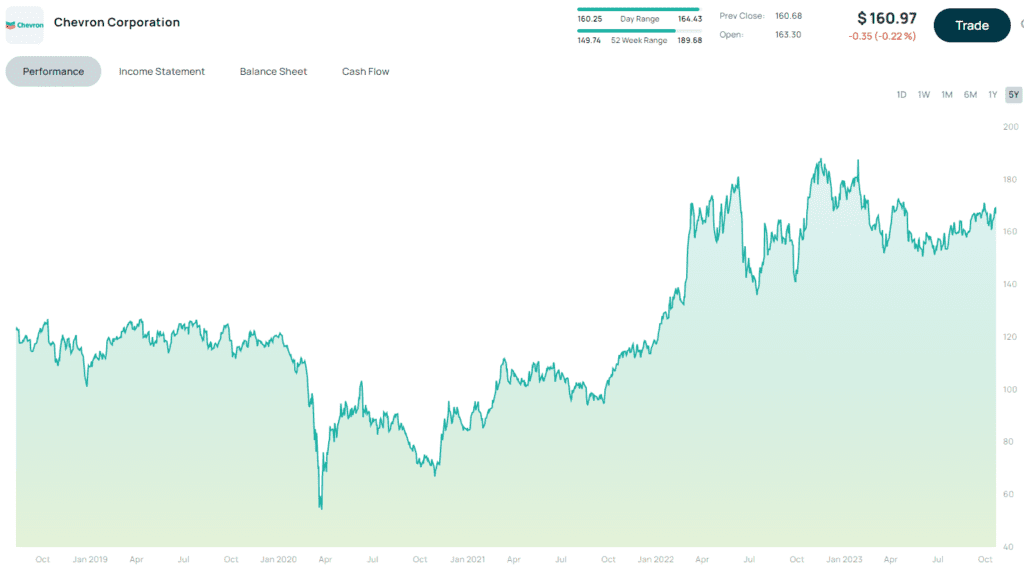

- Energy sector continues to fall afoul of profit-taking

- Chevron‘s $53bn takeover of Hess suggests we’re close to the top of the cycle

- It’s been a massive month for M&A in the US, with $139bn in deals announced