- European stock markets started strong but lost momentum as the US session progressed. Major indices closed at their lowest points of the day.

- There were no significant changes in bond yields and the value of the US Dollar. Commodities experienced slight gains, while concerns about droughts affecting agricultural products seem to be overblown.

- There is a noticeable rotation away from this year’s high-performing stocks, with value outperforming growth by a significant margin. The NYFANG Index, which includes major tech stocks, dropped 2.8%, with Nvidia declining and cheaper alternatives like Intel and Qualcomm gaining.

- Tesla faced a 6.06% drop, while Ford and GM experienced minor gains.

- Office real estate investment trusts (REITs) have been under pressure due to rising vacancies and refinancing risks. However, some positive news emerged with a deal involving SL Green, which sold part of an office block in New York City. This demonstrates that there is still demand for high-quality real estate assets.

- The cruise industry faced a setback following the release of Carnival’s financial numbers. Despite positive outlook statements, the stock price dropped significantly.

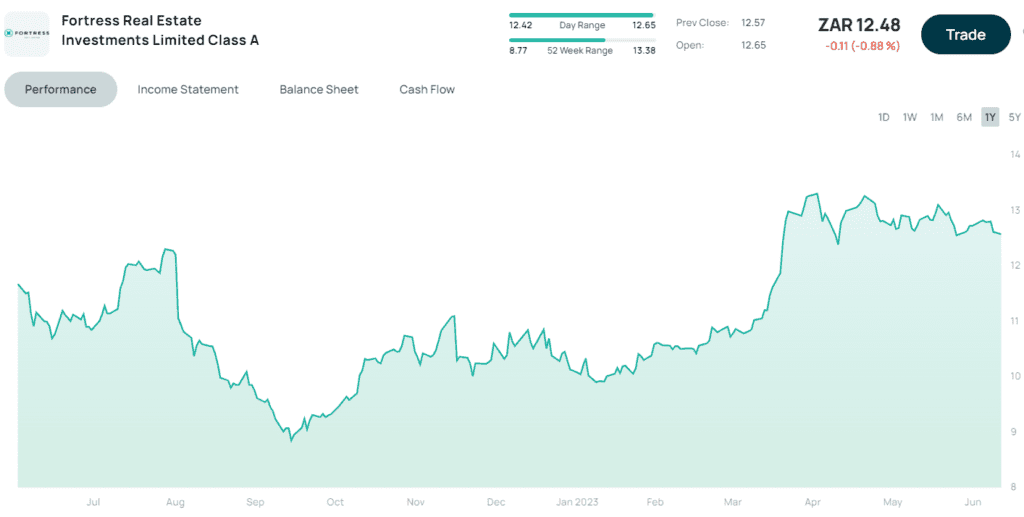

- In terms of local updates, Fortress, a real estate company, provided a positive update on their portfolio. Vacancy rates have improved in some sectors, and their balance sheet remains strong.

- Overall, there is a sense of optimism in the market. Positive developments in the power sector, the absence of a visit from Putin to South Africa, and encouraging performances by retailers contribute to a favorable outlook for investors.

- All eyes today on the Prosus / Naspers restructure announcement, with Prosus up more than 5% and Naspers up more than 7% intraday.