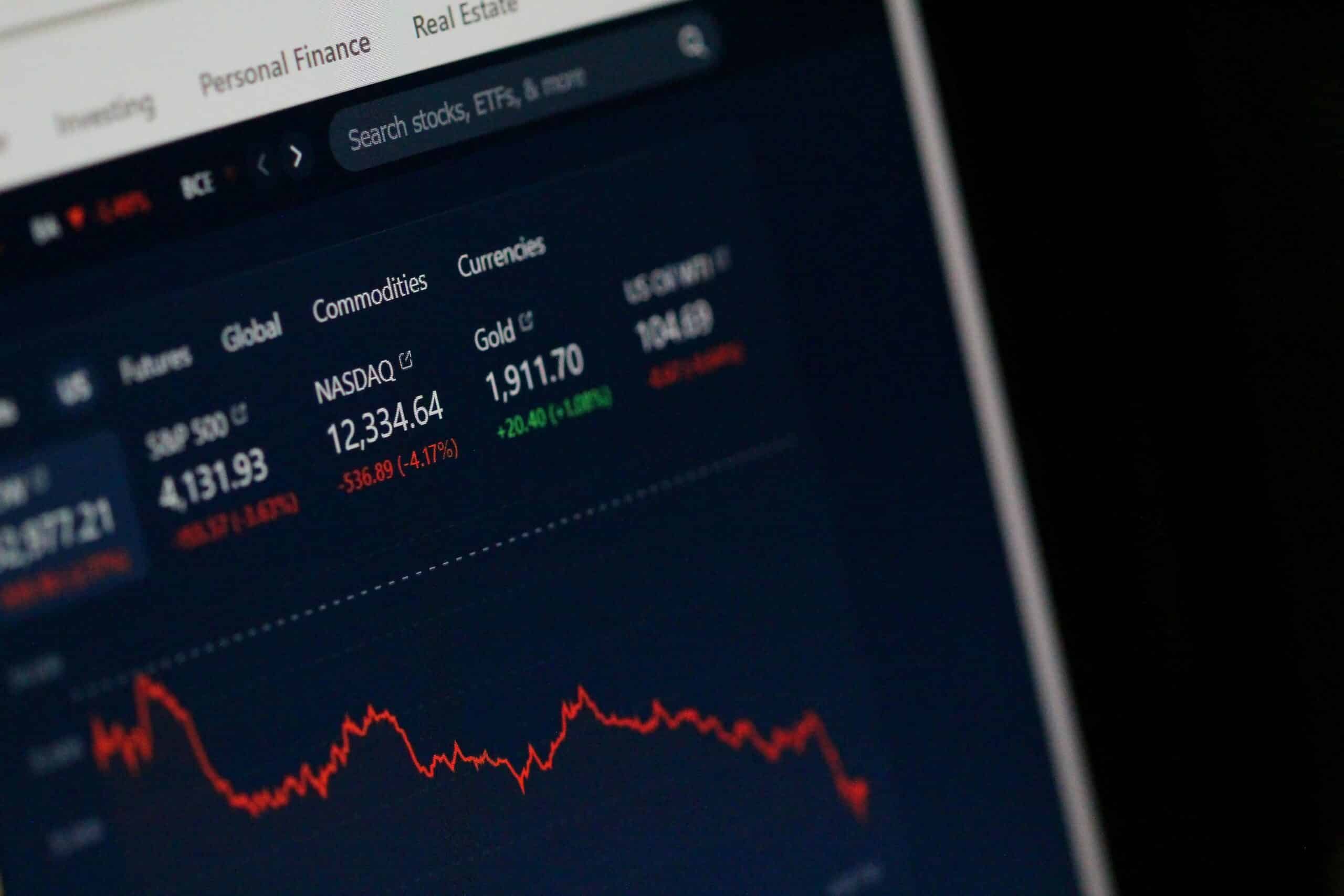

The mini banking crisis is still front of mind with the take over of Credit Suisse (with more than 150 years of legacy) by it’s local competitor UBS in a frantic deal facilitated by the Swiss National Bank over last weekend.

This weekend it was the turn of First Citizens a regional bank that is now 3rd generation family controlled and with the purchase of the SVB assets has become a top 20 bank in the USA.

Politics often interferes with the running of a capitalist society, and the facilitation of the transfer of SVB rather than a total collapse is seen by many as a step too far, and that the bank should have been allowed to fail without guaranteeing depositors …. but … a capitalist society ultimately functions on trust in it’s financial sector and any central bank governor will not want to be the one to allow the system to lose that trust.

Other news from around the world:

- The dollar weakened against most majors as risk sentiment stabilised

- Tencent recovering all of yesterdays losses and a flat ZAR, we can expect to open firmer in thin volumes

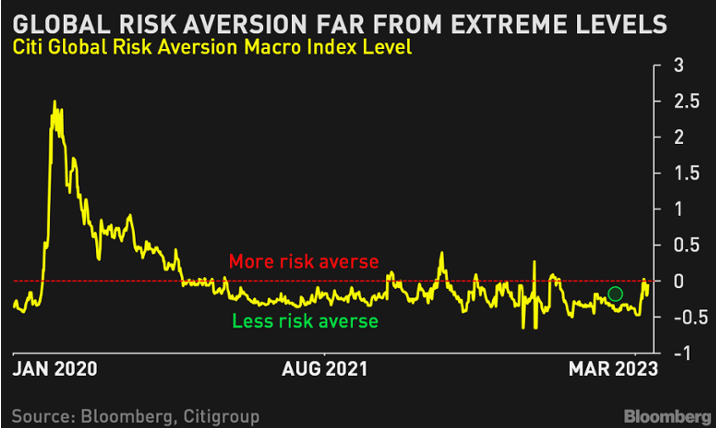

- GAUGE OF GLOBAL RISK AVERSION – is back in benign territory and a long way from levels seen during the pandemic. BBG

Good luck out there