- Inflation data came in slightly lower than expected, which is good news for the markets.

- The major US stock indices, including the Dow, S&P, and Nasdaq, ended the week on a positive note, with significant gains.

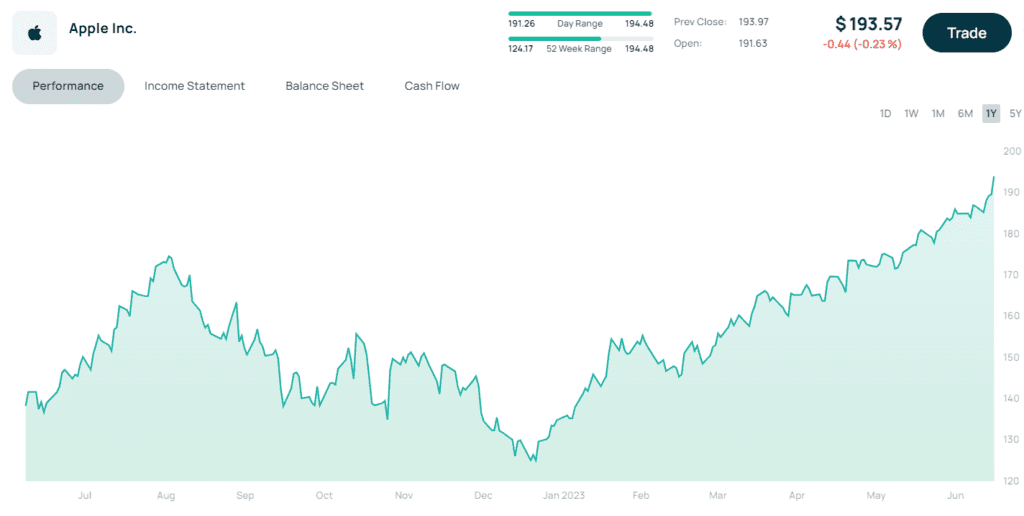

- The Nasdaq had an exceptional first half of the year, delivering a 32% return. The NYFANG Index also performed well, gaining 74%. Notably, Apple became the first company to reach a market cap of $3 trillion.

- Technology, consumer discretionary, and financial sectors showed strong performance, with all major sectors ending in positive territory.

- Commodity markets saw modest gains in oil, gold, and copper. However, there was more action in the softs market, particularly corn, wheat, and soy, due to weather patterns and agricultural reports.

- Some notable stock updates include Nike’s disappointing results and guidance, challenges with inventory management affecting the sector, SoFi’s volatility following the rejection of Biden’s student loan relief plan by the Supreme Court, and Tesla’s record-breaking car deliveries driven by price cuts and effective inventory management.

- Asian markets, such as the Nikkei, Hang Seng, and ASX, are starting the new half of the year on a positive note, taking cues from the strong US market performance and a positive BOJ Tankan survey.

- Tech and cyclical sectors, including materials and industrials, are leading the gains in Asian markets, despite weaker Chinese housing sales and relatively stable commodity futures. However, rhodium prices have experienced a decline.

- It’s important to note that while the tech sector had a remarkable first half, it might not replicate the same level of performance going forward. There is a possibility of a shift towards broader cyclical sectors and emerging markets if China’s performance improves