- Due to the upcoming US Independence Day holiday, trading volumes were low, resulting in a quiet session. US stock indices saw minimal gains.

- The bond market experienced some volatility after the release of manufacturing data, but the initial rally in treasuries didn’t last long.

- In terms of sectors, there was a slight decline in technology and cyclical sectors, while defensive sectors performed relatively better. The China Golden Dragon tech index outperformed its US counterparts.

- Over the past month, there has been a notable shift towards real-world cyclical sectors, with fund managers taking profits from technology and investing in cheaper sectors that have underperformed but show improved prospects.

- Some sectors that have gained recently include steel, trading companies, distributors, construction machinery, building products, and electronic manufacturing. On the other hand, defensive sectors like drug retail, food packagers, and utilities have experienced declines.

- If China’s performance improves, there is potential for a significant rally in emerging markets in the second half of the year.

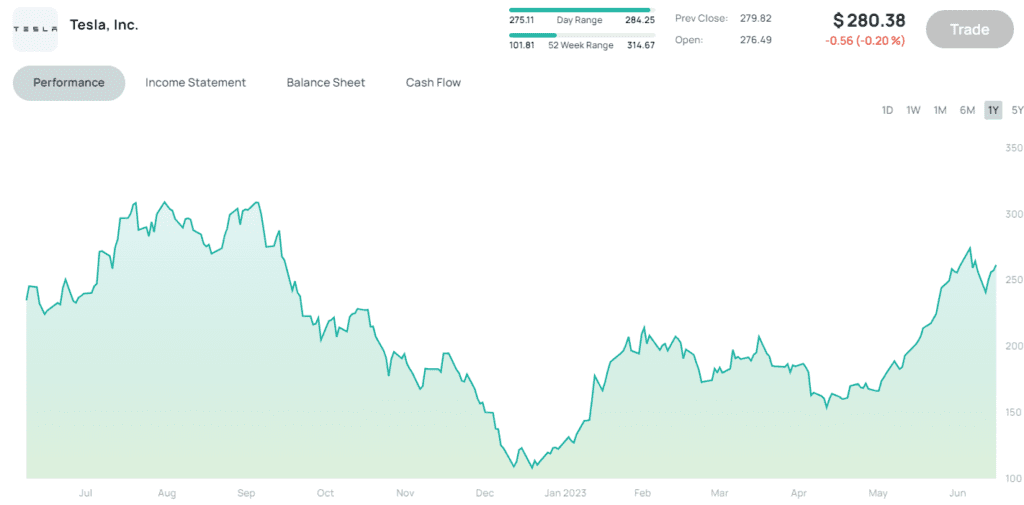

- At the stock level, Tesla had a standout performance with record quarterly vehicle sales, while AstraZeneca declined due to disappointing results from a lung cancer drug trial.

- Asian futures markets are showing positive signs, and there is a sense of rotation in the air.

- The Nikkei index had a strong performance in the first half of the year, while Chinese indices are slightly up, and the Australian ASX received a boost after the Reserve Bank of Australia maintained interest rates.

- Overall, the market’s path of least resistance, including South African companies, seems to be on an upward trajectory.