- Global markets are wrestling with the balance between economic growth and inflation, with both having significant implications.

- Recent US employment data showed mixed results, with better-than-expected nonfarm payrolls but rising unemployment and moderate wage inflation.

- Energy, materials, and financial sectors saw gains, driven by reflation expectations and rising oil prices.

- Media sector stocks, including Warner Bros, Paramount, and Disney, experienced weakness due to contract disputes and cord-cutting trends.

- Hardware sector, represented by Intel, rallied due to growing confidence in personal computer demand.

- Platinum group metal (PGM) stocks declined amid concerns about oversupply in the electric vehicle (EV) market.

- Sales desks remain bullish on companies like EXX and TGA due to increased coal imports by India and China’s plans to build fossil fuel power plants.

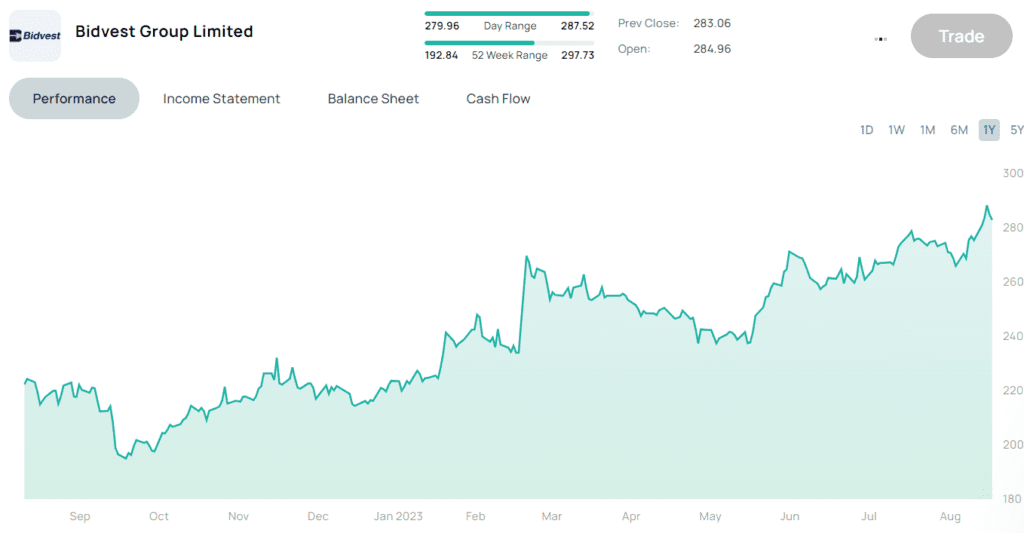

- Local results included AVI’s solid trading statement and Bidvest’s positive earnings report.

- Chinese stimulus measures and optimism boosted Asian markets, particularly in real estate and technology sectors.

- Despite potential benefits of a China rebound, short-term challenges persist for South Africa, including fiscal concerns and energy shortages.