- Last week’s labour data was seen as good news for the US economy, with weaker non-farm payrolls and a lower unemployment rate. However, average hourly earnings data was slightly ahead of expectations.

- Treasury bonds did well, but equity markets had a lacklustre close to a soft week. The S&P looks expensive and earnings season has been a case of “travel and arrive”.

- Only 58% of corporates are surprising for the right reason when it comes to topline. However, 80% of corporates continue to beat street expectations when it comes to earnings, with staples being the highlight.

- The bid for cyclical value remains in place, but investors will focus on China, broader EM, miners, the UK, Europe, and chemicals.

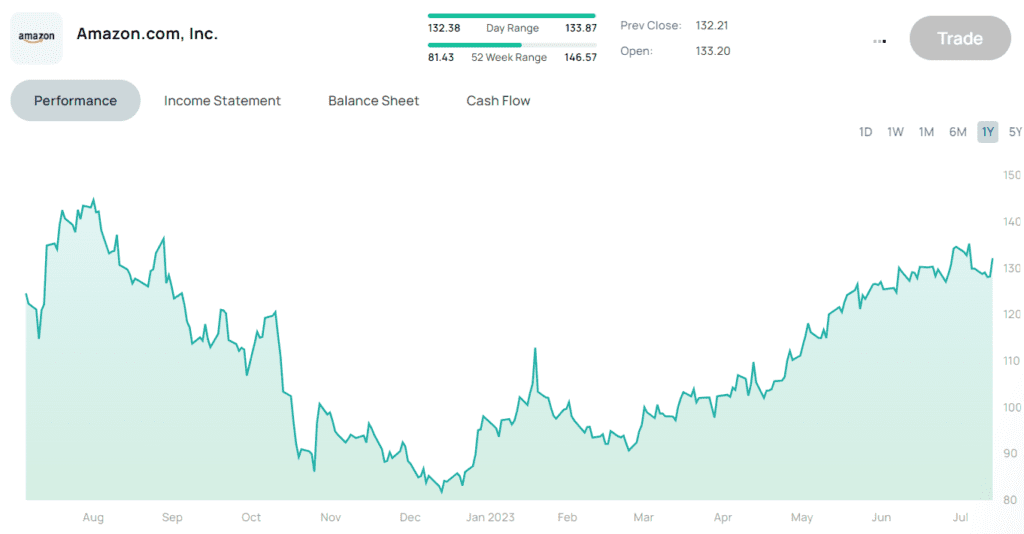

- Amazon had a great result, but Apple’s iPhone demand was soft. Draft Kings is now profitable at EBITDA level, but still loss-making at the bottom line. Fortinet and Redfin struggled, while EV maker Nikola and WW International had declines in YoY sales.

- Warner Brothers Discovery is bringing news and live sports to their streaming offerings to grow the customer base and push pricing.

- The US and China are establishing new lines of communication to engage on sensitive issues, and Chinese beer makers are catching a bid as the government removes anti-dumping tariffs on Aussie barley.

- Positive commodity moves include coking coal and ZAR 6E PGM basket, while negative moves include iron ore fines and lump, nickel, lithium spodumene, and silver.