- The market has been performing well this year due to two main factors. Firstly, excitement around artificial intelligence and new tech products, which is boosting investor sentiment in a period of slow growth. Secondly, the likelihood of a US recession has decreased over time, providing further confidence to investors.

- Federal Reserve managed inflation well, without causing harm to the economy, but uncertainty remains about rate-hiking cycle.

- The recent market sell-off can be attributed to a combination of factors, including the hawkish tone in the Fed minutes, positive economic data, and the strong performance of the equity market so far this year.

- While we are approaching the end of the current cycle, expectations of rate cuts in December may be too optimistic; with a couple more rate hikes possible.

- The Market recovered losses by end of session; the oil sector declined due to lower natural gas prices and refining margins, Exxon issued profit warning.

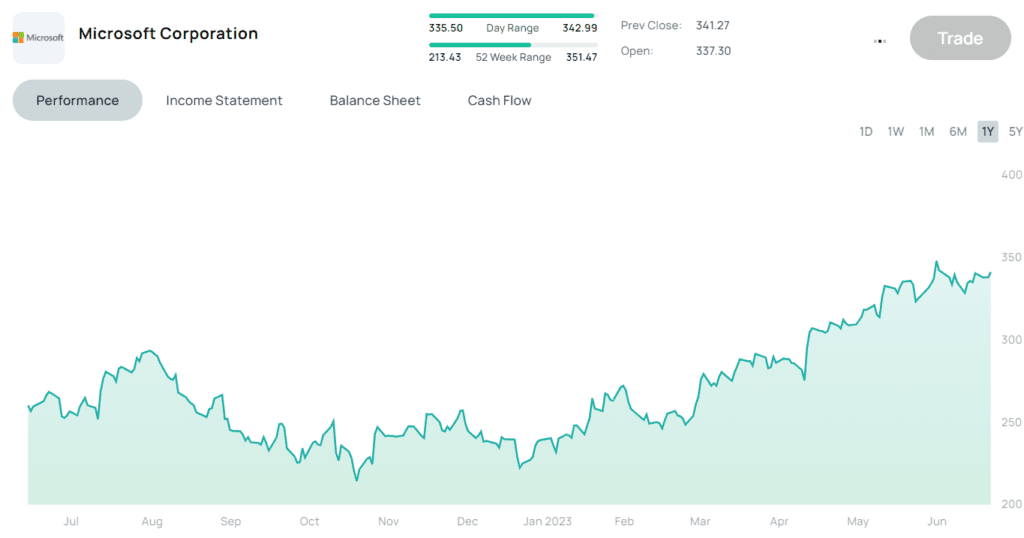

- In terms of individual stocks, the technology sector, especially software services, showed strength; Microsoft received positive upgrades, Sweetgreen stock rose with increased foot traffic in CBDs, Uber faced challenges with minimum wage requirements.

- Meta, the company behind Threads, had a decline in its stock price despite a large number of user sign-ups. It will be interesting to monitor Thread’s progress in the future.