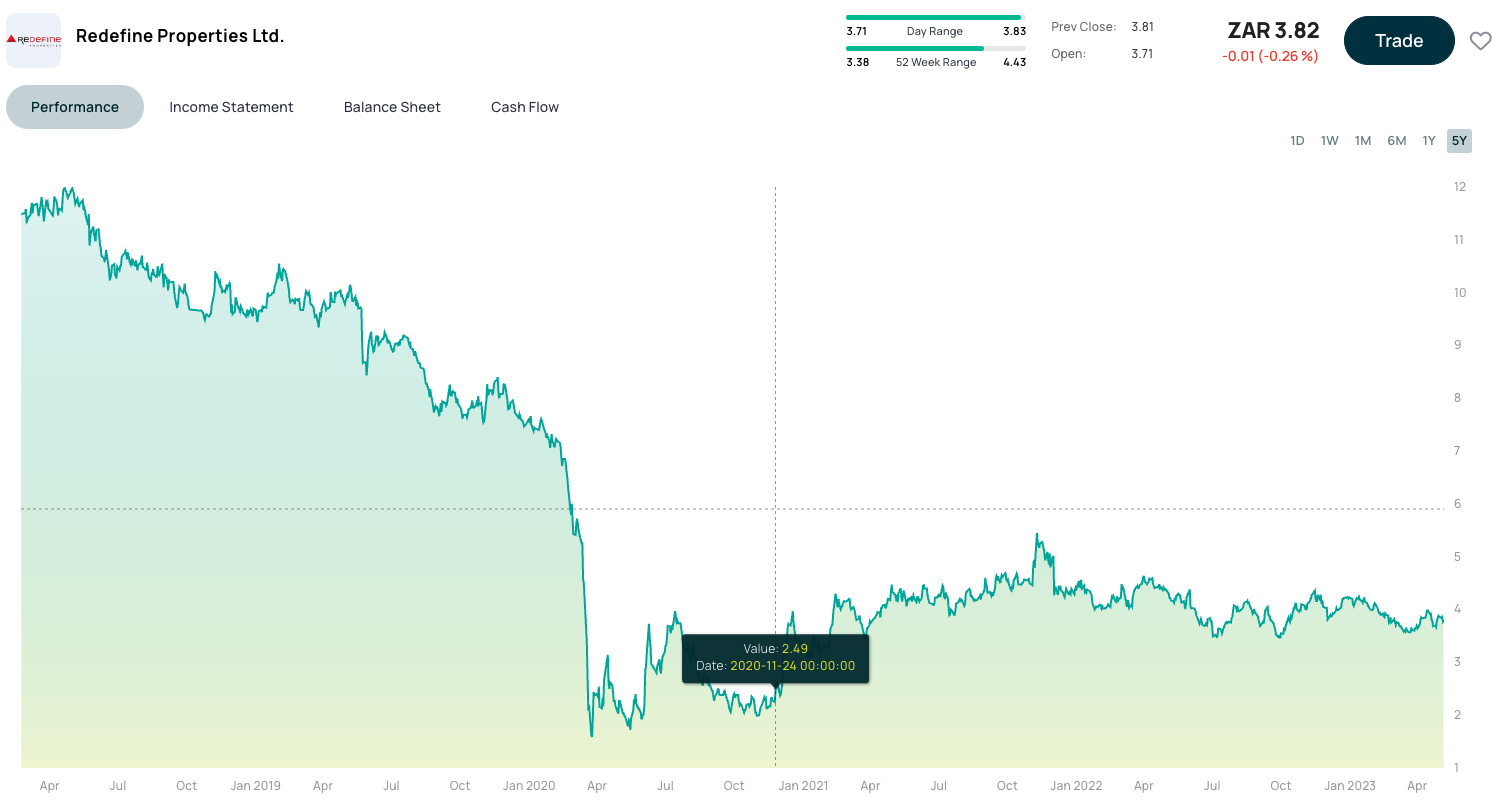

Property counters in SA have never recovered from the big valuation adjustment through Covid 19. Growthpoint (below) is a case in point: still down circa 60% from its highs 5 years ago.

Property counters are trading at significant discounts to NAV and attractive dividend yields above 10%.

This could be an attractive entry into the property sector, and if you can handle the mark-to-market on a CFD, the yield on the property counters should easily cover the financing charge.

ZAR -> Clarity -> RDF

Here is a select summary of the markets as of this morning, 7AM SAST:

Stock markets experienced slight declines with low trading volumes, and Chinese stocks dropped after the release of import & export data and crackdowns on espionage in consulting firms. Ongoing debt ceiling discussions continue to affect US interest rates and the US Dollar. A mix of companies reported earnings, including Coty, Under Armour, AirBnB, Rivian, Affirm, Upstart, and Wynn. Equites Property Fund delivered solid operational results, but a drop in net asset value (NAV) was driven by devaluations in UK properties.

Key Points:

- Stock market declines: Dow down 0.17%, S&P down 0.46%, and Nasdaq down 0.63%.

- US interest rates and the Dollar continue to be affected by debt ceiling negotiations.

- Earnings reports: Coty is down 3.22%, Under Armour is down 5.66%, AirBnB is down 12% after hours, Rivian is up 5.6%, Affirm is down 8% after hours, Upstart is up 40% after hours, and Wynn is down 1%.

- Equites Property Fund reported a 4.1% increase in dividend income per share for FY23A but a 10.5% decrease in NAV due to a 21% decline in UK property valuations.

- Equites Property Fund provided lower dividend income guidance for FY24E and is focusing on adjusting dividend income and executing 7 strategic initiatives.

As a retail investor, it’s essential to keep an eye on the stock market trends and earnings reports of various companies. This information will help you make informed investment decisions and better understand the factors impacting the value of your investments. Additionally, be aware of ongoing economic and political events, like debt ceiling negotiations, as they can influence financial markets and currencies.