Tesla (TSLA-NASQ) is betting big that self-driving robotaxis will be the next major hyper-growth trend fuelling company revenue and profits into the future.

Reuters reported recently that Tesla had cancelled a planned low-cost car and will instead develop self-driving robotaxis on the same platform. However, Tesla CEO Elon Musk denied this on his X.com account.

Regardless, Tesla is set to unveil its robotaxi on August 8, showcasing its driverless vehicle platform called Full Self-Driving (FSD) for the first time.

In a letter to clients, an analyst from wealth management, brokerage and advisory firm Wedbush Securities characterised Tesla as “more of an AI and robotics play than a traditional car company” with the robotaxi launch on August 8 set to start a new chapter in the Tesla story, serving as a pivotal development in the carmaker’s ability to regain its $1 trillion valuation.

CEO of Ark Investment Management, Cathie Wood is far more bullish on the potential within the robotaxi market, suggesting it could be worth trillions, with the potential to deliver 10-fold returns on Tesla stock.

“We think that the robotaxi opportunity globally will deliver $8 to $10 trillion in revenue by 2030 and is one of the most important investment opportunities of our lifetimes,” said Wood.

“One of the reasons for this is that it will save lives; 80-90% of auto fatalities and accidents are caused by human error, and autonomous driving is going to take away the human error.”

A Morgan Stanley note to investors supports this view, stating that the unveiling could set the tone for Tesla beyond 2030 due to the impact and influence that fully autonomous technology will have on the world.

The investment bank believes that “Tesla has many attributes that can make it a formidable player (if not an outright winner) in the race to autonomy” and that “the more material commercial scaling of the business would be well beyond 2030”.

However, Alphabet (GOOGL-NASQ) subsidiary Waymo has already beaten Tesla in putting rubber on the road. After years of testing, the Waymo One service went live in San Francisco in March 2024, allowing all residents and visitors the opportunity to ride in one of the company’s modified Jaguar EVs.

A Swiss Re study of Waymo vehicle performance has already demonstrated an 85% reduction or 6.8 times lower crash rate involving any injury, from minor to severe and fatal incidents.

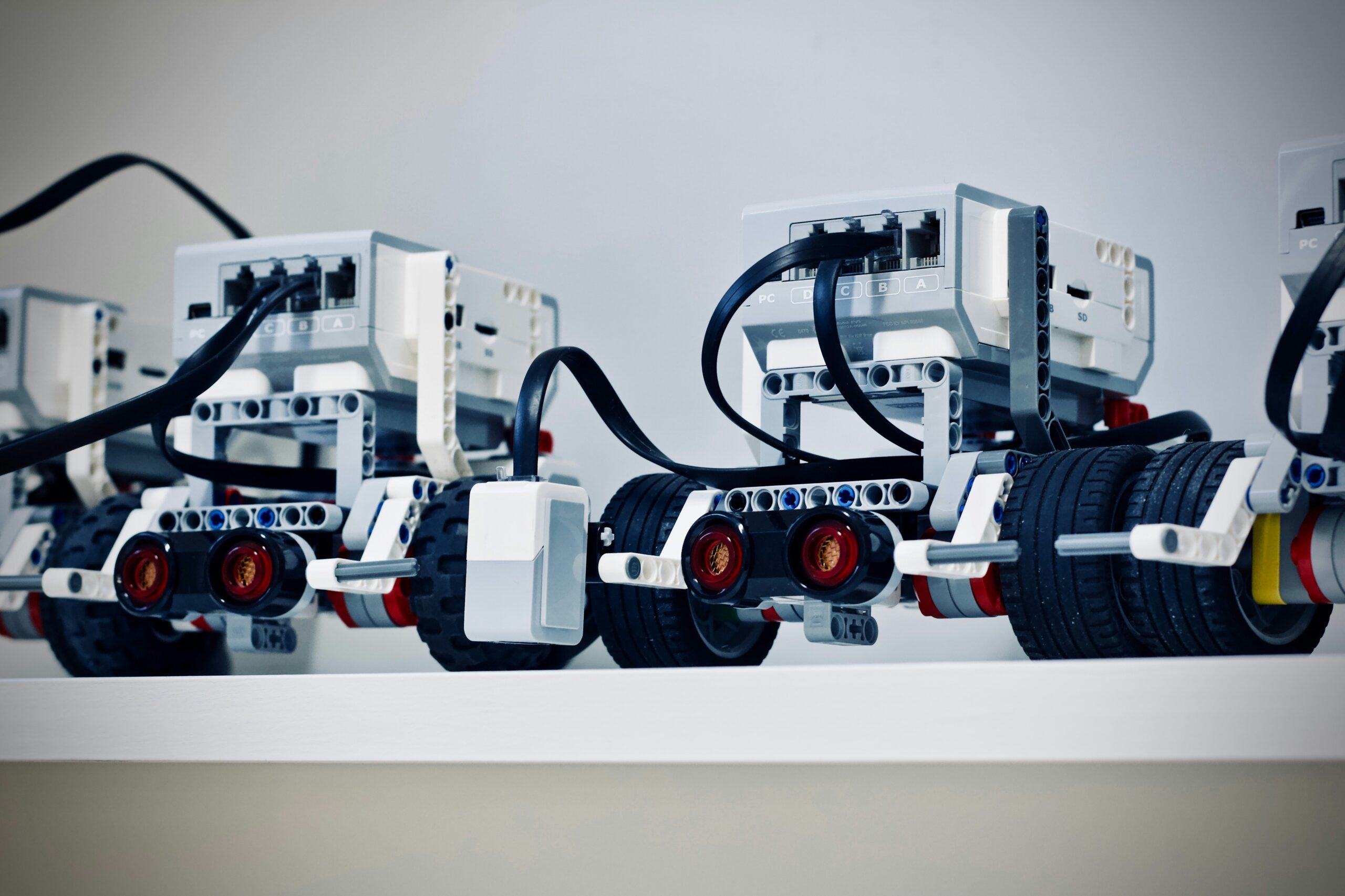

Rimac is another electric vehicle (EV) manufacturer that is driving autonomous vehicle innovation. The company recently launched Verne, an autonomous robotaxi startup named after author Jules Verne, the “father of science fiction”.

The startup debuted its futuristic EV robotaxi in June 2024 at an event in Rimac’s hometown of Zagreb, Croatia. The vehicle incorporates Mobileye technology and will allow riders to summon the robotaxi via a mobile app. Verne will launch in Zagreb in 2026, followed by the UK, Germany, and the Middle East, eventually deploying the robotaxis worldwide.

In more general terms, the McKinsey & Co Centre for Future Mobility Report released in 2017 already highlighted the potential for self-driving robotaxis to revolutionise the global auto industry, calling it a “mega-trend”.

According to the report, this will require the expansion of four mobility mega-trends – autonomous driving, connectivity, electrification, and shared mobility – which will have “game-changing effects on the automotive market”.

The report states that autonomous driving could decrease the total cost of ownership (TCO) to public transport levels, reducing a fleet operator’s TCO by 30-50% compared with private-vehicle ownership and by about 70% against shared mobility, significantly disrupting the mobility market.

Additional disruptions beyond the automotive sector could include the insurance industry by improving fleet management and lowering accident risks.

While the unveiling at Tesla will serve as a seminal moment on the journey to self-driving robotaxis and alter the future complexion of auto-maker and broader mobility sectors, developing autonomous vehicles has proved challenging for companies, including Tesla, which started development in this regard as far back as 2018.

In a further example of the challenges faced in the industry, OpenAI-backed autonomous driving software firm Ghost Autonomy closed worldwide operations in April 2024, citing the uncertain path to profits, despite significant funding from private equity firms, including the OpenAI Startup Fund.

The Cruise autonomous unit within General Motors (GM-NASQ) also came under regulatory scrutiny after a vehicle injured a pedestrian. The U.S. automaker subsequently slashed jobs and cut spending on the division by $1 billion.

However, in the aftermath, GM CEO Mary Barra said there were “huge benefits with autonomous technology” and the company had an “incredibly valuable asset”.