- Yesterday, the stock market didn’t see much action despite a slight increase in bond yields, a weaker US dollar, and a drop in oil prices due to the Gaza ceasefire extension. The Dow, S&P, and Nasdaq all saw small declines. However, this setup is good news for our investments, especially for precious metals, which saw a nice bounce.

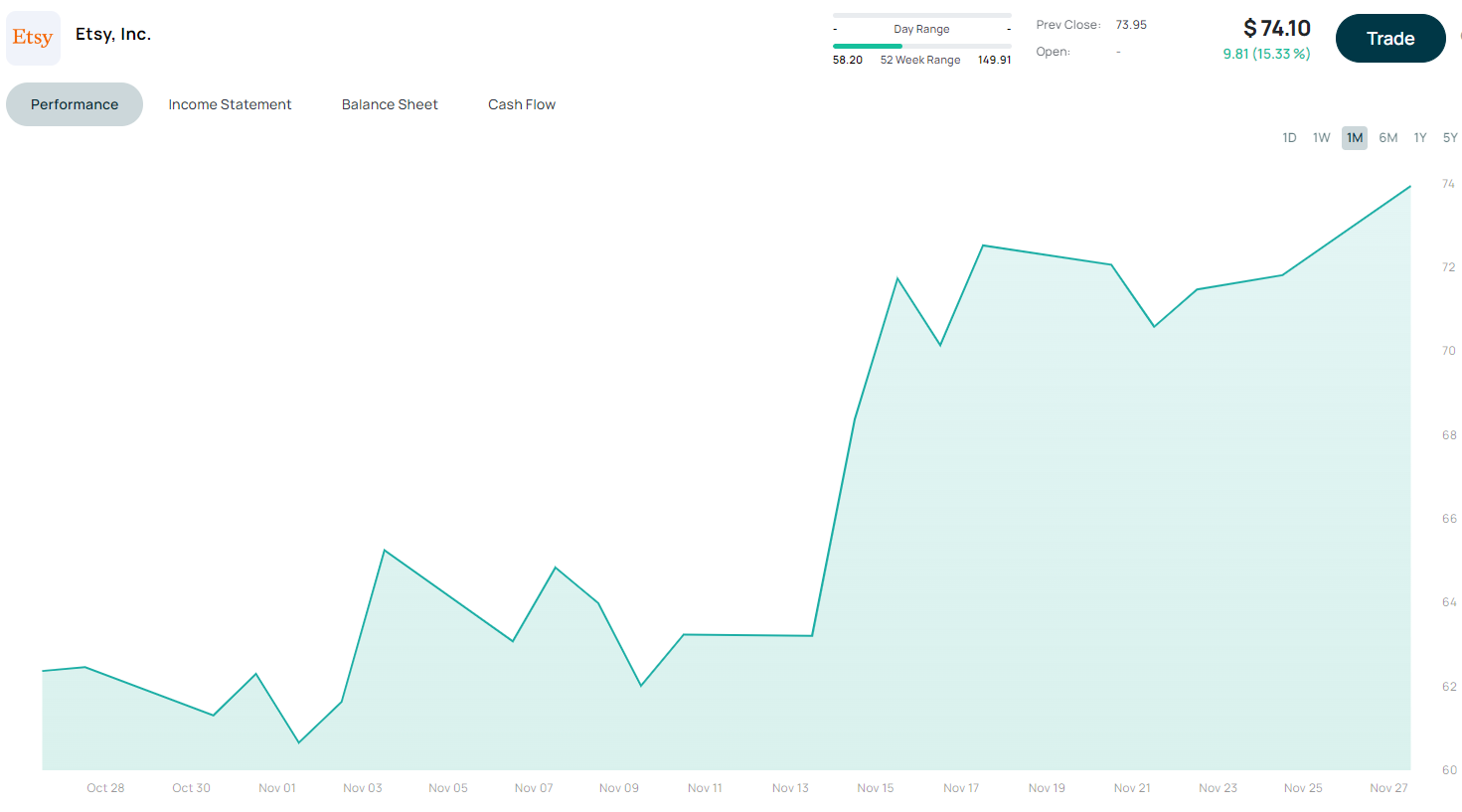

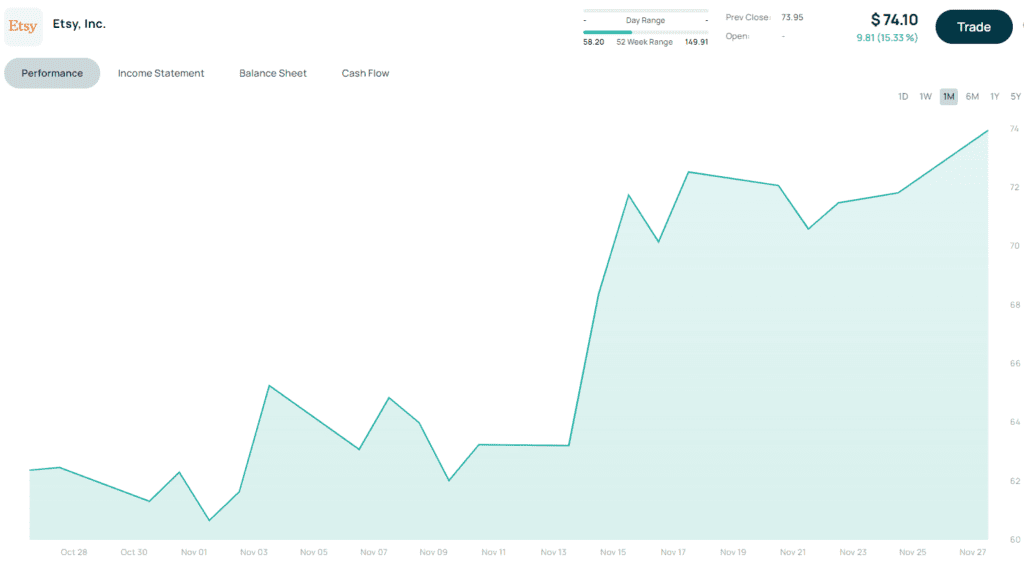

- The focus is still on the US consumer, and Black Friday sales were strong, with online sales up 7.5% YoY to $9.8bn. Cyber Monday is expected to break records with an estimated $12.5bn in sales. Companies like Shopify (+4.89%), Etsy (+3%), and Affirm (+12%) saw significant gains due to the increased demand for their products.

- Disney‘s new animated movie, Wish, didn’t perform well during its opening weekend, causing the company’s stock to drop by 1%.

- In other news, the Kiwi government has reversed a smoking ban for anyone born after 2008 due to financial reasons. This decision shows that when things get tough, environmental, social, and governance (ESG) concerns can take a back seat.

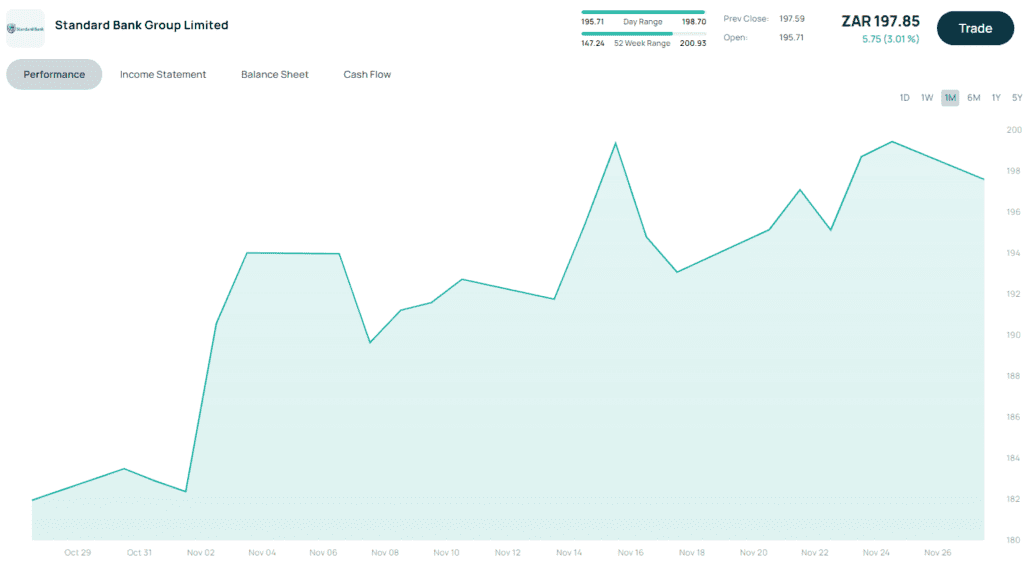

- On the local front, Standard Bank reported strong performance for the first 10 months of the year, which is in line with expectations. The bank has done well, but there may be challenges ahead, and next year will be interesting.

- The Asian market saw a soft session today, with the Nikkei and Hang Seng both down slightly. Tencent saw a decline of 1.12%.

- Finally, there was a rally in the PGM market yesterday, but it’s not clear what caused it. Short-term supply cuts are needed, but the long-term demand narrative is uncertain.