What’s a Black Swan event and are there any predicted for 2025?

In the context of financial markets, a Black Swan event is a highly improbable and unpredictable occurrence that has an extremely negative impact, which usually has dire consequences for global and local economies and society at large.

Is it time to switch to cyclical stocks?

With a slowdown in growth likely, professional investors like the institutional investment team at Investec are recommending a rotation away from the expensive tech stocks that delivered significant growth in 2024, and a shift in focus to cyclical stocks.

Thematic investing explained

Investors have different strategies at their disposal to express their investment thesis, with the use of a thematic investing approach gaining significant traction in recent decades.

Thematic investing is a forward-looking approach that aims to capitalise on emerging themes and predicted long-term trends rather than immediate market fluctuations or the fundamentals of individual companies.

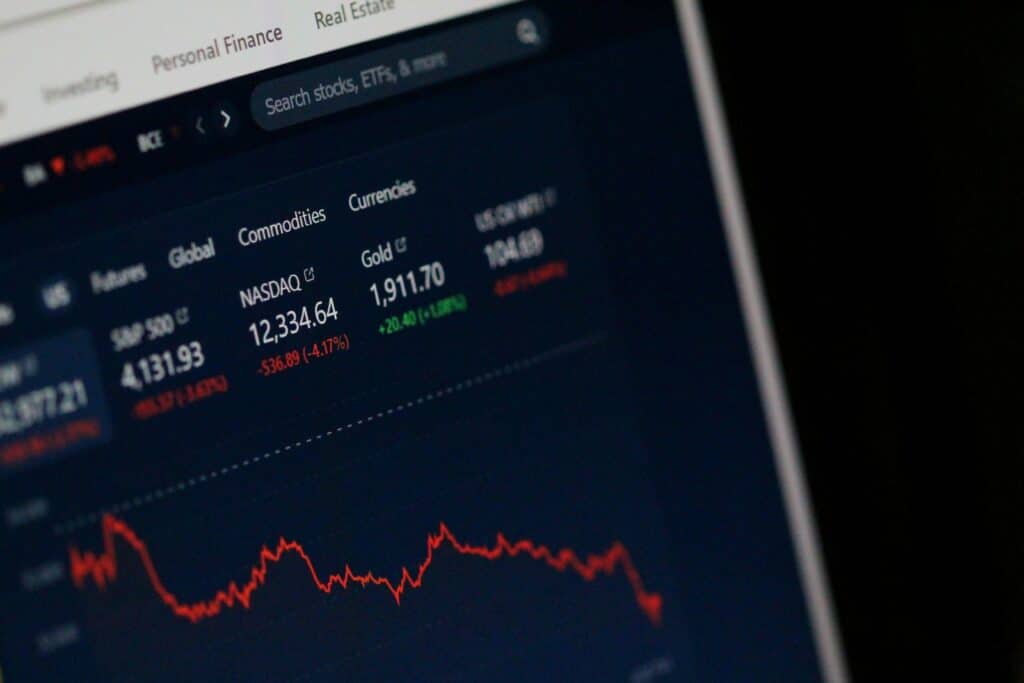

Bubble, bubble, toil and trouble!

If there is one market phenomenon that investors fear most, it’s a stock market bubble, because when it bursts, stock prices can crash, and investors in those stocks can lose a lot of money.

Bubbles typically develop when stock prices rise rapidly, growing beyond their intrinsic value – the true value of a company based on fundamentals like earnings, assets, and future cash flows.

Clarity into the 2025 trading outlook

As another year comes to a close, it is critical that self-directed investors and traders take time to review their portfolios, assess the lessons from their 2024 trades, and conceptualise their investment thesis for the next 12 months.