Thematic investing explained

Investors have different strategies at their disposal to express their investment thesis, with the use of a thematic investing approach gaining significant traction in recent decades.

Thematic investing is a forward-looking approach that aims to capitalise on emerging themes and predicted long-term trends rather than immediate market fluctuations or the fundamentals of individual companies.

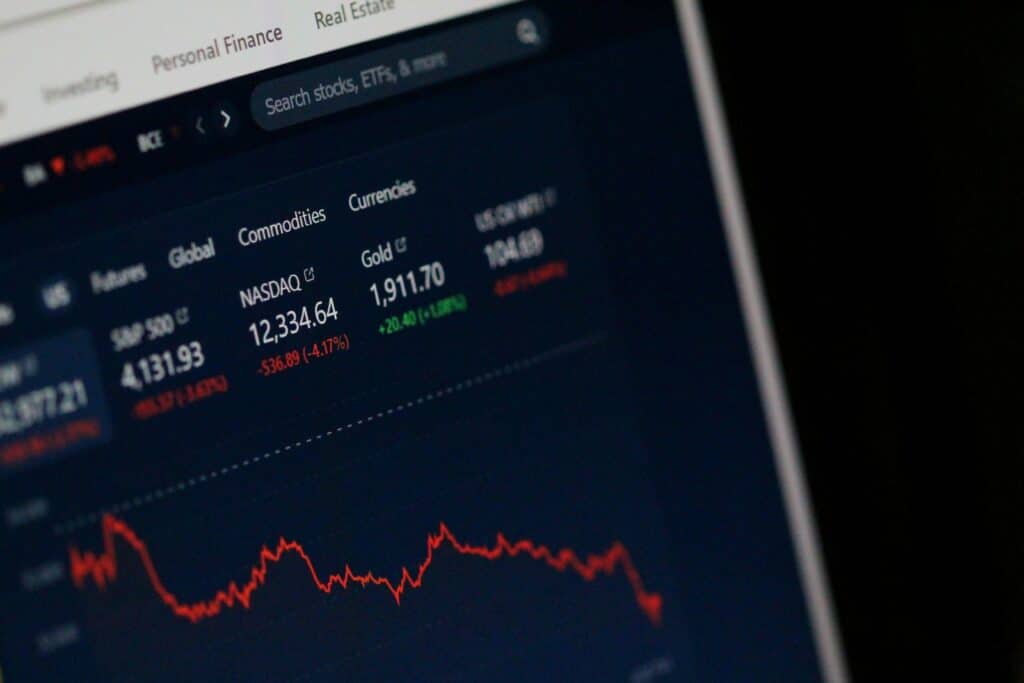

Bubble, bubble, toil and trouble!

If there is one market phenomenon that investors fear most, it’s a stock market bubble, because when it bursts, stock prices can crash, and investors in those stocks can lose a lot of money.

Bubbles typically develop when stock prices rise rapidly, growing beyond their intrinsic value – the true value of a company based on fundamentals like earnings, assets, and future cash flows.

Clarity into the 2025 trading outlook

As another year comes to a close, it is critical that self-directed investors and traders take time to review their portfolios, assess the lessons from their 2024 trades, and conceptualise their investment thesis for the next 12 months.

The importance of constantly assessing your trading positions

A trading position is a strategic decision that involves buying, selling or holding a financial instrument, such as a stock or currency, with the expectation of profiting from future price movements.

Traders will select when to enter and exit positions based on research and in-depth analysis to maximise potential returns.

Trumpism 2.0 and markets

We explore the potential implications for markets from another Trump term