7 August : US Labour Data Mixed, Amazon Soars, Apple Falters, Warner Bros Expands Streaming

Last week’s US labour data showed a mixed bag of results, with weaker non-farm payrolls and a lower unemployment rate. Amazon had a great result, but Apple’s iPhone demand was soft. Warner Brothers Discovery is expanding its streaming offerings to grow its customer base and push pricing.

11 May : From Disney to Mining

Good news from the U.S.: Inflation data came out better than anticipated, which lowered the return on bonds (yields). This led to an initial uptick in the stock market, especially for tech companies. However, the overall increase was only modest.

Disney’s shares took a hit: Despite solid profits and sales, and good performance from their theme parks, Disney’s shares fell. This was due to worries that the cost of their streaming services will increase losses in the future.

Big moves in the mining sector: Australian mining company Allkem is merging with US firm Livent. This kind of activity might make you question whether the mining industry is nearing a peak.

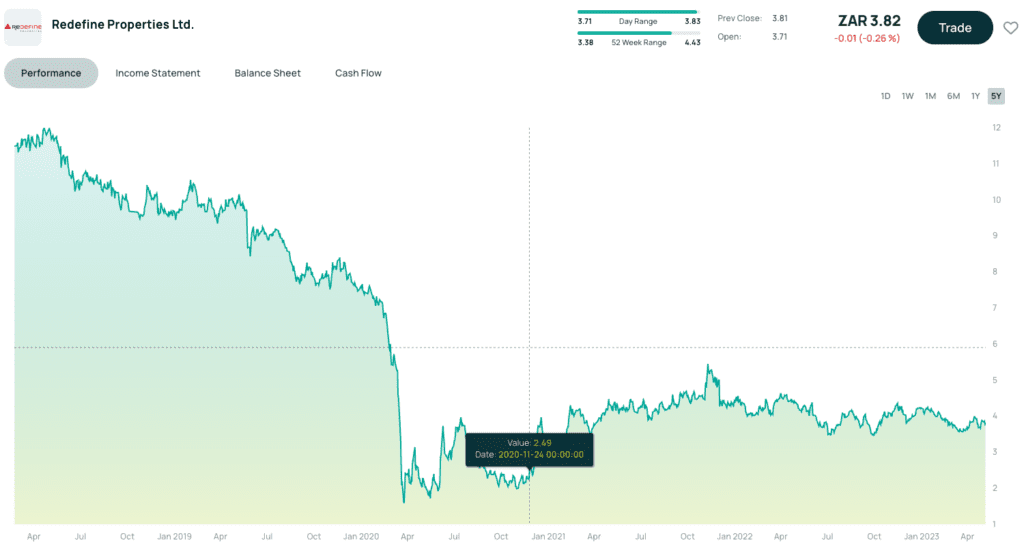

10 May : Depressed property

Property counters in SA has never recovered from the big valuation adjustment through Covid 19. Property counters are not only trading at big discounts to NAV but also at attractive dividend yields of significantly above 10%.

5 May: Taking a bite out of the BIG APPLE

Apple released results last night that beat estimates across the board on the back of better iPhone sales. Total Revenue came in at $94.8bln ahead of the analyst estimates of $92.6bln. CEO Tim cook also singled out India as the most populous country in the world now plays a more important role in both production […]

28 Mar : First Citizens … not The First Citizen to the rescue

This is a mini banking crisis, not a whole melt down.