What is index rebalancing and why should you care about it?

Investing in indexes is a simple and convenient way for self-directed investors to gain broad market exposure to a collection of stocks and other assets representing a financial market segment.

Thematic investing explained

Investors have different strategies at their disposal to express their investment thesis, with the use of a thematic investing approach gaining significant traction in recent decades.

Thematic investing is a forward-looking approach that aims to capitalise on emerging themes and predicted long-term trends rather than immediate market fluctuations or the fundamentals of individual companies.

Bubble, bubble, toil and trouble!

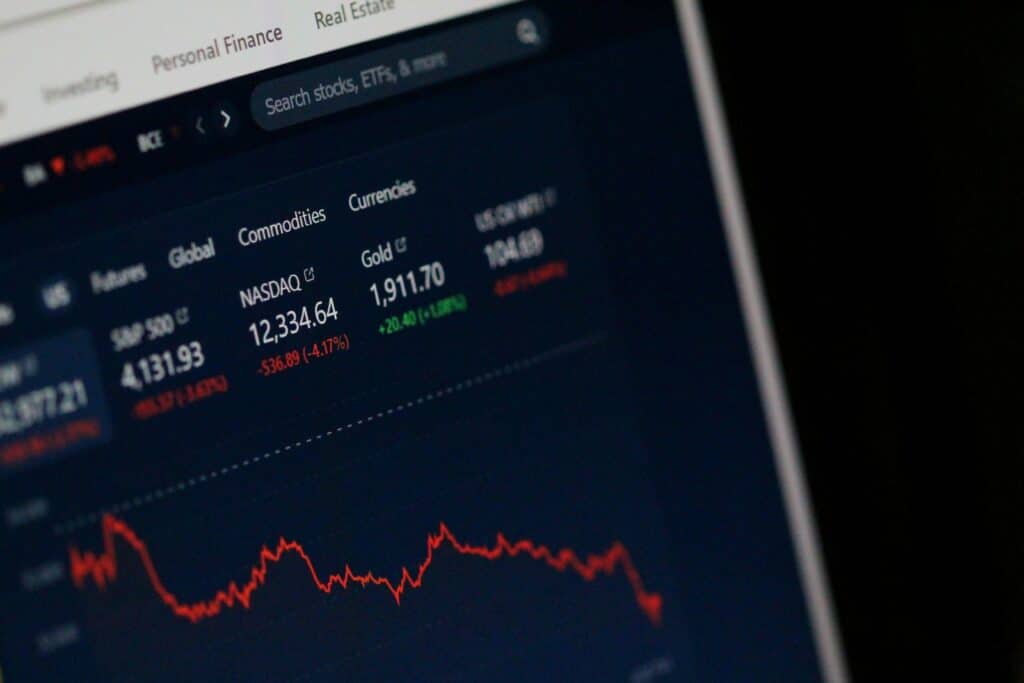

If there is one market phenomenon that investors fear most, it’s a stock market bubble, because when it bursts, stock prices can crash, and investors in those stocks can lose a lot of money.

Bubbles typically develop when stock prices rise rapidly, growing beyond their intrinsic value – the true value of a company based on fundamentals like earnings, assets, and future cash flows.

Clarity into the 2025 trading outlook

As another year comes to a close, it is critical that self-directed investors and traders take time to review their portfolios, assess the lessons from their 2024 trades, and conceptualise their investment thesis for the next 12 months.

Trading update : 18 December 2024

Europe is falling further behind the dominant US as a developed market of choice for global investors. The 20-country eurozone finds itself in a difficult position with economic indicators continuing to point to a loss of momentum while the recovery in the UK remains slow and complicated. Global investors must consider numerous factors when allocating to developed markets in 2025.