Thematic investing explained

Investors have different strategies at their disposal to express their investment thesis, with the use of a thematic investing approach gaining significant traction in recent decades.

Thematic investing is a forward-looking approach that aims to capitalise on emerging themes and predicted long-term trends rather than immediate market fluctuations or the fundamentals of individual companies.

The importance of constantly assessing your trading positions

A trading position is a strategic decision that involves buying, selling or holding a financial instrument, such as a stock or currency, with the expectation of profiting from future price movements.

Traders will select when to enter and exit positions based on research and in-depth analysis to maximise potential returns.

Why traders should keep a lookout for market dislocations

Temporary misalignments in asset prices, commonly known as market dislocations, present opportunities for traders to earn a profit.

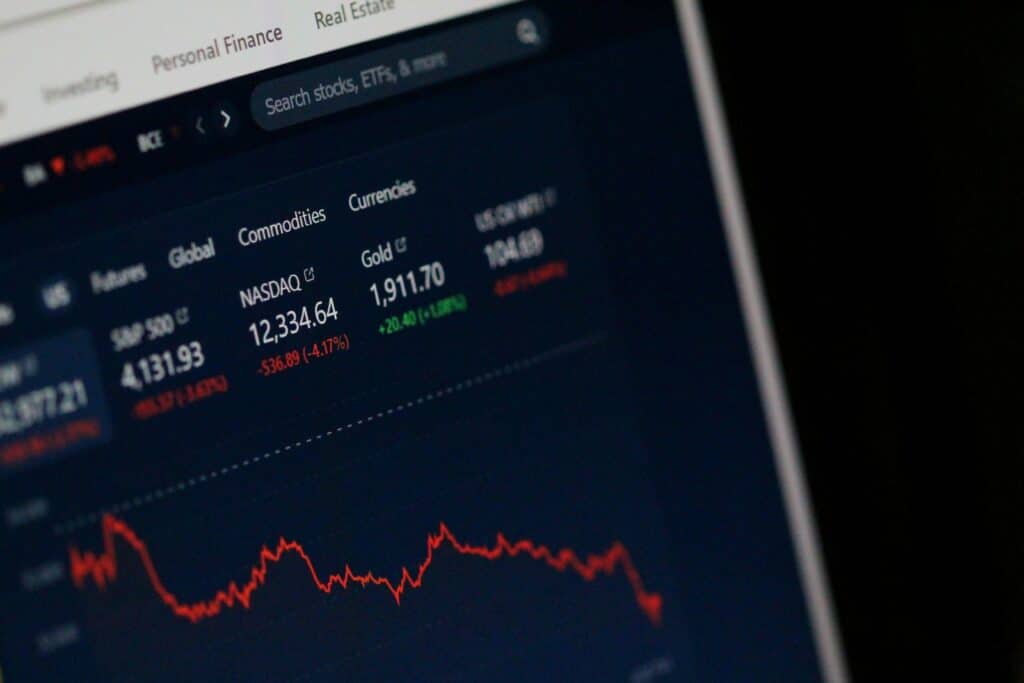

These events typically occur in situations where financial markets deviate from their normal functioning and fail to accurately price assets, which usually happens under stressful or atypical market conditions.

Using market momentum indicators

Momentum indicators help traders understand the potential direction and speed with which a particular stock price will likely change, which can help inform position trades or better understand the strength of price movements to realise a return.

Trading Update : 6 November 2024

M&A activity is alive and kicking in global and local markets, but not all outcomes are positive. Regulators are also coming down hard on companies. Outside the bureaucracy, tech is still a major growth driver with noise from geopolitics becoming increasingly louder as the U.S. election looms.