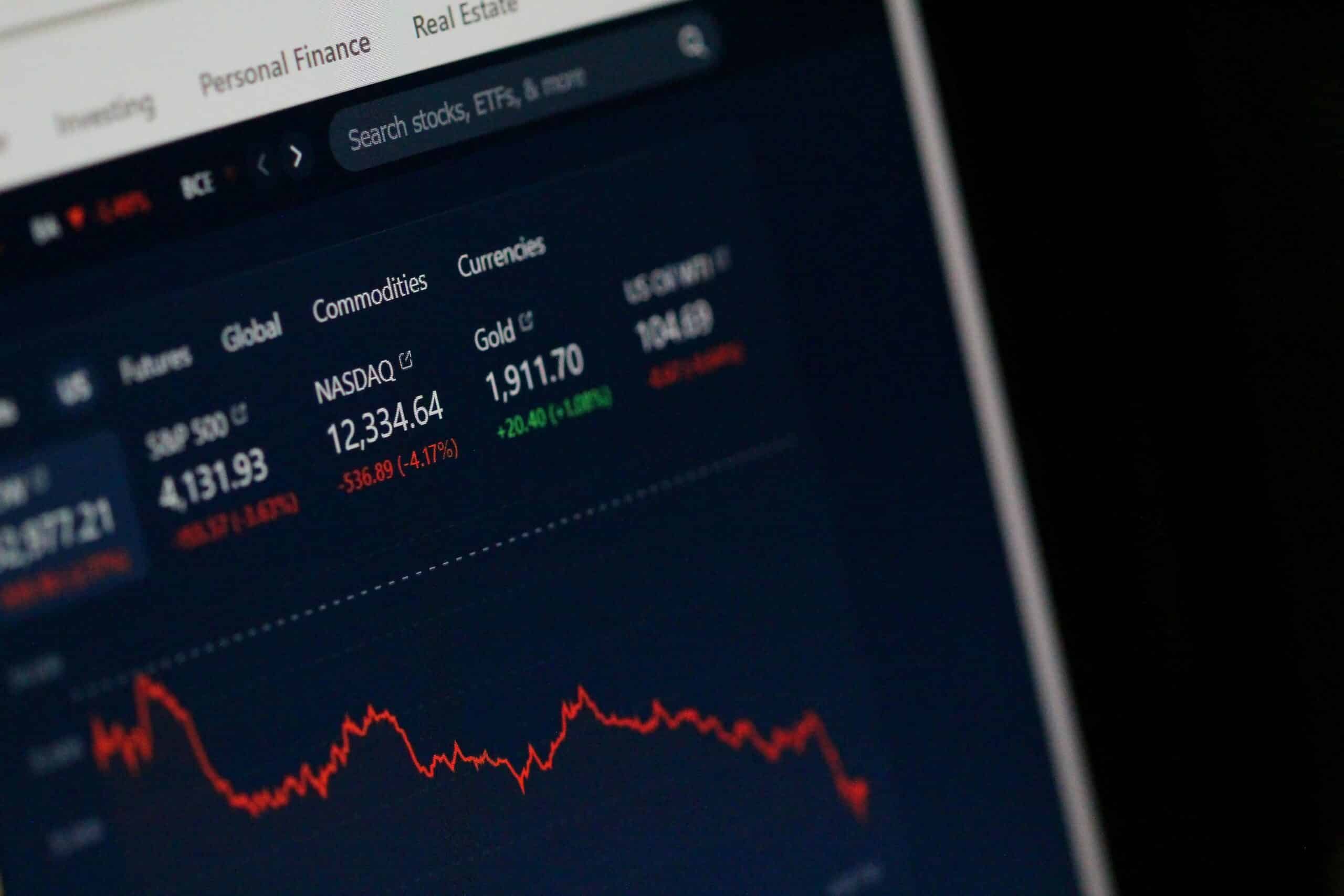

After US stocks slumped on 5 August, with the tech-focused Nasdaq index dropping 6% and the broader S&P 500 index falling by 4.2% when trading opened that week, market commentators have cautioned investors about the potential for a larger correction, or possibly another tech bubble, particularly as the artificial intelligence (AI) theme seemingly loses steam.

But how worried should investors be about a possible bubble or market correction? While no rally or thematic trend is sustainable indefinitely, there are numerous factors to consider before making the decision to rotate away from the tech stocks that have benefited most from the AI boom.

Importantly, AI is not a singular technology, with investment and development across numerous forms and applications currently underway. As such, there is broad potential for multiple profitably scaled businesses to emerge from the current and future waves of AI development.

The major tech stocks investing directly to build out their cloud AI capabilities include members of the ‘Magnificent Seven’, namely Alphabet (GOOG-NASQ), Amazon (AMZN-NASQ), Facebook-parent Meta Platforms (META-NASQ), and Microsoft Corp. (MSFT-NASQ).

The other beneficiaries from the capital expenditure these companies are allocating to build out AI capabilities include companies developing and manufacturing the technologies needed to drive AI advancement, particularly semiconductor and chip makers, most notably Nvidia Corp. (NVDA-NASQ).

Bloomberg data showed that, as of August 2024, 40% of Nvidia’s revenue came from Microsoft, Meta, Alphabet, and Amazon. Conversely, Nvidia accounted for 45% of Microsoft’s capex, 41% for Meta and 14% for Google. Microsoft and Meta alone account for ~30% of Nvidia’s revenues.

Nvidia estimates that total demand for the graphics processing units (GPUs) needed to support AI systems could reach $2 trillion, with $1 trillion from data centres and $1 trillion from work connected to AI, such as training new large language models (LLMs), machine learning and scientific simulations.

Other gainers within the semiconductor sector include Broadcom (AVGO-NASQ), Super Micro Computer Inc. (SMCI-NASQ), Micron Technology Inc. (MU-NASQ), Advanced Micro Devices (AMD-NASQ), and Qualcomm (QCOM-NASQ), while data centre gear makers like Arista Networks (ANET-NASQ) are also rising on AI tailwinds in the broader market.

The fact that firms continue to make significant capex investments in AI suggests that this theme is more than a fading trend, with a strong long-term outlook as the role of AI in the modern business environment expands across enterprise software, cybersecurity, automation, driverless and pilotless transportation, robotics, and various industry and consumer technologies.

Generative AI (GenAI) is the other sub-sector in the broader AI market where investment into development continues to skyrocket, with players like Microsoft-backed OpenAI and Google’s Gemini driving continued innovation while finding new opportunities to apply the technology in practical, value-adding ways.

The 2024 AI Index report produced by Stanford University found that funding for GenAI has surged since 2022, nearly octupling to reach $25.2 billion.

More broadly, insights from Goldman Sachs Economics Research estimates that AI investment could approach $100 billion in the U.S. and $200 billion globally by 2025. Over the longer-term, AI-related investment could peak as high as 2.5 to 4% of GDP in the U.S. and 1.5 to 2.5% of GDP in other major AI leaders, if these AI growth projections are fully realised.

The Goldman Sachs research suggests that these AI investments will focus on four key business segments:

- Companies that train and develop AI models.

- Companies that supply the infrastructure to run AI applications.

- Companies that develop software to run AI-enabled applications.

- Enterprise end-users that pay for AI software and cloud infrastructure services.

These continued investments are unsurprising given the potential that AI holds to transform the way we work and live. For instance, researchers from the BlackRock Investment Institute stated in a research note that “AI could usher in a transformation on par with the Industrial Revolution”.

A JP Morgan report also identifies AI as “one of the most revolutionary technological advancements in recent history”, and maintains its stance that it represents “a multi-year opportunity” with returns on AI investment only starting to show up in corporate bottom lines.

The need to continue investing in AI is also evident in earning calls, with CEOs at most tech companies stating that underinvesting risks being left behind in the AI race, which suggests that capital expenditure will not slow down anytime soon.

Intel (INTC-NASQ) offers an instructive insight on these risks, with the stock sinking -26% after the CEO gave a very frank admission that the business doesn’t look fit for an AI world and will cut 15,000 jobs as a result.

These factors suggest that any rotation away from AI stocks is likely premature, despite the recent market volatility. The fundamentals driving the AI theme support continued growth in the sector, even with any normalisation in the current AI-related capital expenditure cycle.