3 June 2024 - Repo rate updates

In another unanimous decision by the MPC, the repo rate was left unchanged at 8.25%, which is in line with market expectations. The tone of the statement and Q&A session was balanced with a slight dovish tilt, although the MPC remains highly data-dependent in an uncertain world.

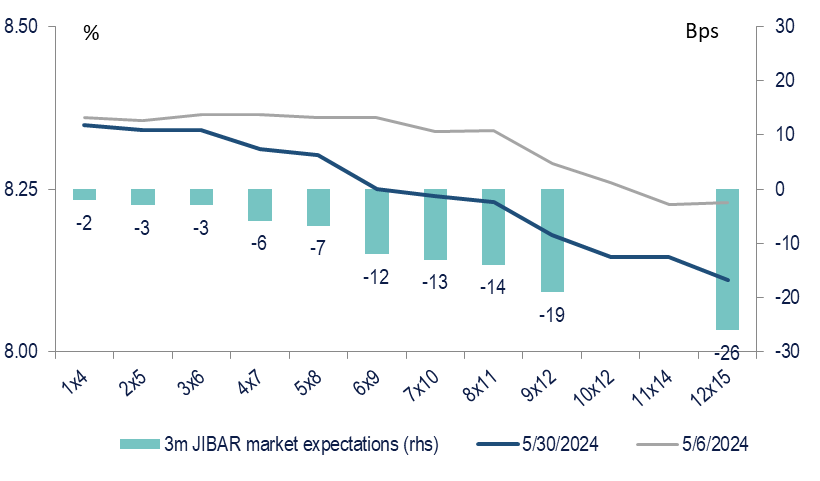

FRA curve vs our interest rate forecast: Before the MPC meeting, the FRA curve assigned a probability of only 20% to a 25bps rate cut by November 2024. This increased to 40% in the wake of the meeting. We do view this as too conservative, as we continue to forecast two rate cuts of 25bps each in September and November and a total of 100bps by mid-2025.

We had three focus areas around the May MPC meeting that could shift the needle from hawkish to neutral/dovish. These were the inflation forecast, the balance of risk assessment and possible comments about the inflation target.

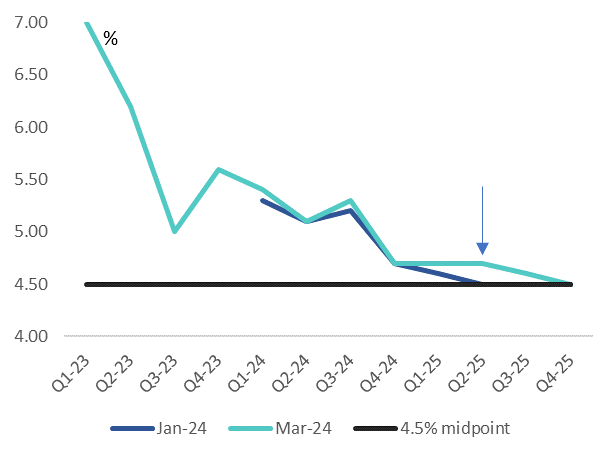

- Inflation forecast: The SARB lowered its inflation forecast as expected, but most of the revision was in 2025. The SARB sees the inflation target of 4.5% to be reached in Q2 25 from Q4 25 previously. This can primarily be ascribed to lower inflation outcomes in March and April. Our forecast expects inflation to reach the target as early as Q4 24 (SARB 4.7%). The key driver in the SARB’s revisions is lower inflation outcomes in March and April, with lower food price inflation (2024 5.1% vs 5.5%) countered by higher fuel price inflation (2024: 3.9% from 1.4%). The SARB expects inflation to average 5.1% in 2024 (unchanged) and 4.5% in 2025 (P: 4.6%).

- Balance of risk assessment changed from the upside to broadly balanced: This has been the first balanced assessment since 2021, when the rate hiking cycle commenced in November 2021. The Governor’s opening statement of “We had an uncertain start to 2024, but recently, developments have been somewhat more positive”, paved the way for toning down a very hawkish March statement to a “slightly dovish” statement and Q&A session in the May meeting. The removal of the upside risks can be attributed to the following developments:

- More benign inflation outcomes in the US recently and implied Fed fund rates that are pricing in 35bps of rate cuts by December 2024.

- In EM, real policy rates are currently restrictive, with key concerns of USD strength and US monetary policy. In South Africa, the MPC has previously stated that the repo rate is restrictive and that the outlook for the rand is one of the risks in the balance of risk assessment that remains upside. The rand has recently appreciated to a ten-month high against the dollar in 10 months (R18.07/$, and trading at R18.60/$ at the time of writing). The outcome of the election and implications for economic policy will become apparent in the coming weeks, culminating in the delivery of SONA later in June.

- The oil price is trading at $83/bbl, after wider geopolitical risk premiums raised the price to $90/bbl in April. The SARB sees the probability of an oil price above $100/bbl as less probable and forecasts prices near current levels.

- The country risk premium has declined as SAGB yields have rallied (although some of the decline has been reversed in the recent week), although they remains well above fair value levels.

- Upside risks remain a higher oil price and the rand, whereas downside risks emanate from services inflation such as housing.

- Inflation target: The SARB will be engaging with the National Treasury regarding the appropriate inflation target and the sacrifice ratio to lower the inflation target to a certain level. This will also include matters such as administered price inflation, driven more by revenue forecasts.

SARB’s All item and core CPI inflation forecast. Source: SARB, ICIB

FRA curve waiting for the election outcome. Source: Bloomberg, ICIB

Tertia Jacobs, Treasury Economist and Fixed Income Analyst at Investec