- Good news from the U.S.: Inflation data came out better than anticipated, which lowered the return on bonds (yields). This led to an initial uptick in the stock market, especially for tech companies. However, the overall increase was only modest.

- Disney’s shares took a hit: Despite solid profits and sales, and good performance from their theme parks, Disney’s shares fell. This was due to worries that the cost of their streaming services will increase losses in the future.

- Big moves in the mining sector: Australian mining company Allkem is merging with US firm Livent. This kind of activity might make you question whether the mining industry is nearing a peak.

- South African retailer struggles: TFG, a South African retail company, has shown signs of a slowdown in sales. They’ve announced plans to tighten their belts next year.

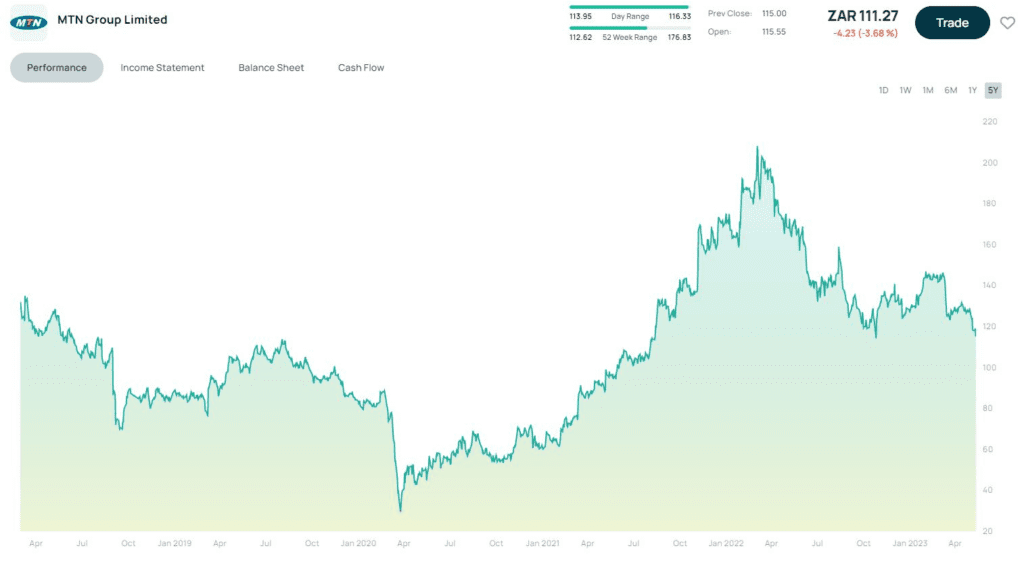

- Telecommunications company making strategic moves: MTN is in advanced talks to make a deal with Axian Group. We’ll need more details to see how this might impact their value.

- Concerns about Transaction Capital (TCP): TCP, a South African company, saw a significant drop in their share price, leading to worries about their future earnings and ability to bounce back.

- High-end consumers feeling the pinch: Those in the high-income bracket are feeling the impact of higher interest rates. This might lead to less spending from this group.

- A credit crunch on the horizon?: There’s a surge in applications for credit, but a low approval rate. People are using credit to balance their income and expenditure, which may not be sustainable in the long run.

- Housing and auto markets show mixed results: High-end homes are seeing a drop in price growth. In the auto market, crossover vehicles are on the rise.

As a retail investor, it’s essential to keep an eye on the stock market trends and earnings reports of various companies. This information will help you make informed investment decisions and better understand the factors impacting the value of your investments. Additionally, be aware of ongoing economic and political events, like debt ceiling negotiations, as they can influence financial markets and currencies.