An increasing number of socially conscious investors want their capital to do good in the world while still earning a fair return.

This demand for socially responsible and ethical investment options, particularly among the emerging Gen-Z demographic, has given rise to a new investment theme in markets known as sustainability or impact investing.

These investors want to support companies that think about elements beyond just the bottom line. In this regard, sustainability refers to company practices or projects that meet the world’s current economic and growth needs without compromising the ability of future generations to meet their own needs.

In investing, the sustainability theme focuses on companies that consider environmental, social, and governance (ESG) factors in their operations or provide solutions to society’s sustainability challenges.

Generating value from investment capital

In essence, ethical investing focuses on deploying investor capital to support companies that align with an investor’s values by promoting sustainable business practices and social and environmental causes that benefit society or the planet (or, even better, both!) while generating competitive financial returns.

And sustainable or ethical investing is by no means a monolithic theme: Sustainability encompasses multiple sectors and companies. Sustainable investments can include renewable energy, resource efficiency, clean water, and social responsibility initiatives like poverty eradication, hunger alleviation, gender equality, or access to quality education, among others.

Multiple ways to invest

Investors can invest in sustainability in various ways, with different asset classes and platforms available to support their preferred causes.

For example, investors can buy individual shares in companies that champion decarbonisation and reduce carbon emissions to achieve net-zero targets through renewable energy projects, or those that commit to good corporate governance, management and administration.

These practices can include ethical sourcing, global supply chain transparency, or proactively demonstrating climate-change action through transparent and comparable company disclosures, such as verifiable Carbon Disclosure Project (CDP) or Task Force on Climate-related Financial Disclosures (TCFD) reporting.

Examples of ESG-aligned stocks include electric vehicle (EV) manufacturers like Tesla (TSLA-NASQ) and Aptiv (APTV-NASQ), companies focused on environmental sustainability like Xylem (XYL-NASQ), a leader in developing innovative water solutions through smart technology, and NextEra Energy (NEE-NASQ), the world’s largest producer of wind and solar energy.

Thematic ESG investment funds

Asset managers have also responded to the demand by creating thematic funds, with exchange-traded funds (ETFs) or unit trusts that only invest in ESG-aligned companies.

For instance, investors can support various sustainability themes, such as clean energy, female empowerment through custom portfolios that only purchase shares in women-led businesses or funds that support emerging markets.

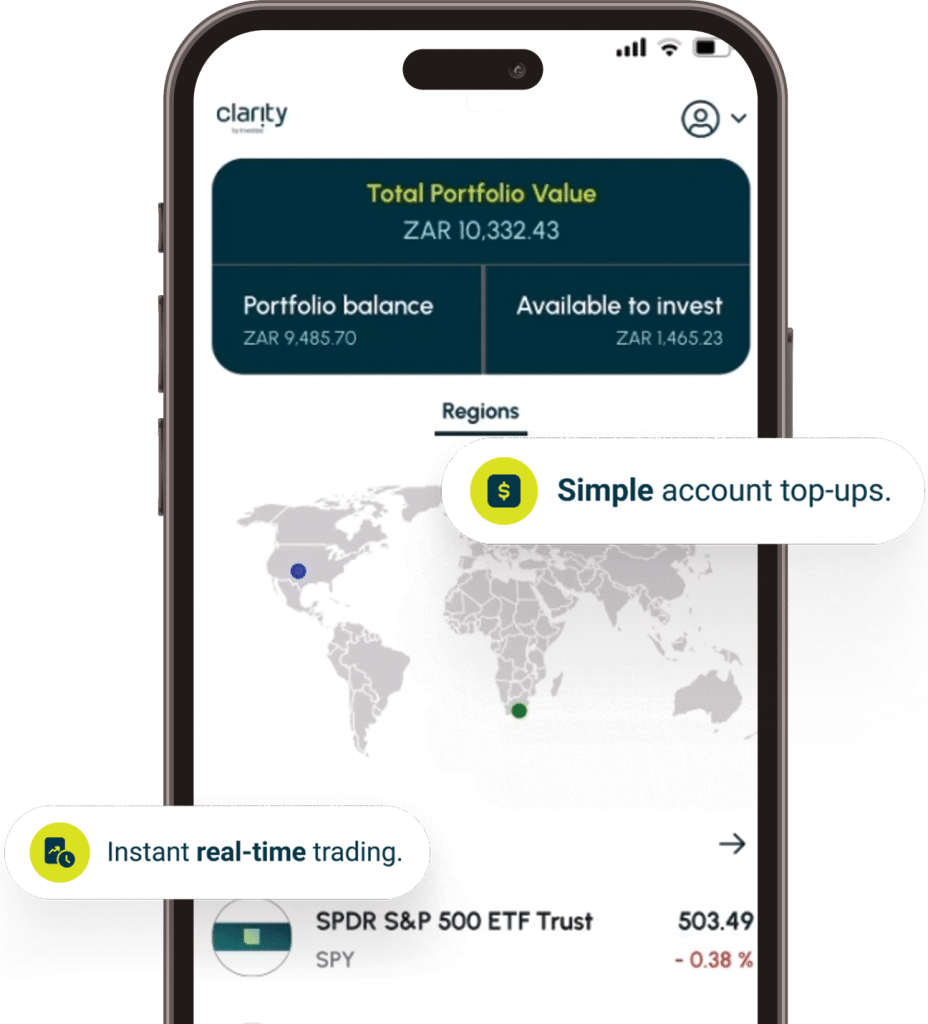

Examples include the iShares ESG Aware MSCI EAFE ETF (ESGD-NASQ), iShares ESG Aware MSCI USA (ESGU-NASQ), iShares Global Clean Energy (ICLN-NASQ), and the UK-based iShares Global Clean Energy UCITS (INRGL-TRQX) ETFs available on the Clarity, by Investec platform.

ESG ETF issuers – the entity that creates, registers, and manages the ETF – typically construct the portfolio by including quality investments with long-term capital appreciation prospects and unique risk and return characteristics.

Asset managers like Investec also offer investors additional avenues to access ESG-aligned investments. For example, the Investec Global Sustainable Equity (GSE) Fund prioritises investment into companies that operate in line with the United Nations’ 17 Sustainable Development Goals (SDGs).

The 17 SDGs are underpinned by 169 individual targets, which have been encoded into government action plans. They represent observable and tangible opportunities for companies to offer solutions and services to help achieve them. Through the fund, investors are able to invest in companies that Investec believes can provide attractive investment returns over the long term, through the lens of the SDG framework.

Doing good while doing well

Beyond the social and environmental benefits, companies that promote longer-term, sustainable thinking in terms of business strategy and promote a management culture that cultivates and rewards a sustainable way of doing business should deliver long-term sustainable returns.

Investing is sustainability can also potentially deliver long-term growth, as sustainable practices and new technology innovations can lead to cost savings, brand reputation, and future-proof businesses.

Moreover, companies that align with evolving environmental regulations and shifting consumer preferences also position themselves more favourably for more sustainable future growth.

However, sustainable funds may not outperform traditional funds in all market conditions. As such, investing in sustainability to have a positive impact on the planet and society should form part of a suitable diversified investment strategy that aligns with an investor’s financial goals.