Take-Two Interactive; decline.

Take-Two Interactive, a prominent player in the gaming industry, experienced a significant decline of 4.1% as it received news about the delay of its highly-anticipated video game, Grand Theft Auto VI. The game, which had generated immense anticipation among gamers and investors alike, will now be released in 2026, extending the wait for its release. This unexpected delay had a negative impact on Take-Two’s stock performance, causing a decline in its value.

FedEx; improved profit margins.

On Friday, FedEx emerged as the top performer among large-cap stocks, experiencing a 7.3% increase in value following the announcement of improved profit margins. However, despite this positive development, the stock has not yet reached its peak levels from 2021 due to the challenges posed by the demanding logistics industry, which operates on low margins and high pressure. Although there was a slight decline in year-on-year revenue growth, this was effectively countered by cost-cutting measures, a substantial $5 billion buyback program, and earnings that surpassed market expectations.

Tesla; reducing production.

In response to a decline in demand, the company is reducing production at its plant in China. Tesla’s stock has experienced a significant decline of 30% in 2024, dropping below important support levels. The company is scheduled to announce its Q1 delivery figures in early April.

Spotlight on the Telco industry 🔦

The telecommunications sector encompasses companies that facilitate global communication via telephones, the internet, wireless networks, and cables. These companies play a vital role in establishing the infrastructure required for transmitting data in various formats worldwide.

However, growth in this sector has considerably decelerated over the past decade, necessitating innovation for survival in the coming decades. Investors have been cautious about this sector due to valid reasons. Disappointing growth in South Africa and foreign exchange challenges in neighboring countries have contributed to this sentiment. Nonetheless, much of the negative news has already been factored into current stock prices. It is important to take note of the recent performance of currencies like the Kenyan Shilling (relevant for VOD) and the NGN (relevant for MTN), as they can have an impact on the sector’s outlook.

Tencent Holdings Ltd. - results are out.

After last week’s results, Tencent Holdings Ltd. has announced plans to significantly expand its stock buyback program in 2024, aiming to raise it to a minimum of $12.8 billion. This move is aimed at reassuring investors who were worried about the potential slowdown in growth during a period of economic downturn in China and after a weaker-than-expected 7% rise in fourth-quarter revenue.

.

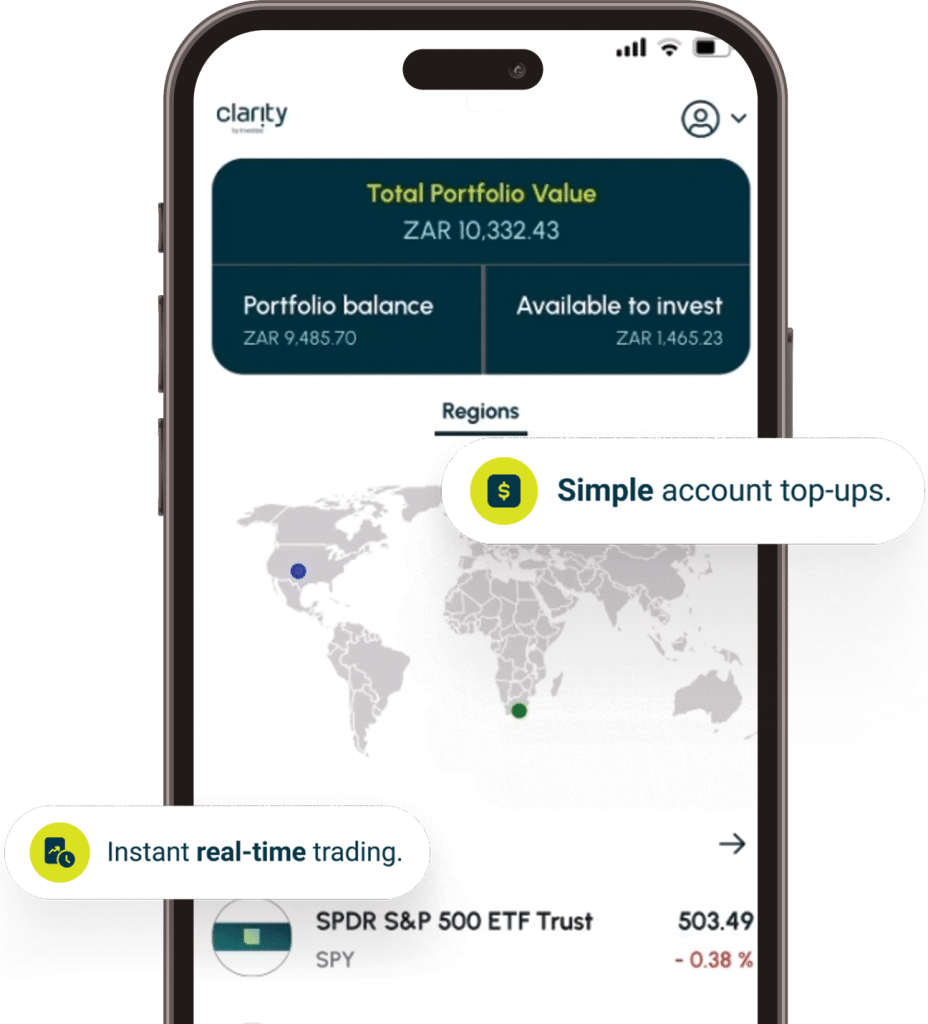

Top 5 instruments traded on Clarity by value for the last 7 days:

1. Nvidia

2. Compagnie Financiere Richemont SA

3. Shoprite Holdings Ltd