Numerous factors influence global financial markets, from economic growth, global supply chains, geopolitical events, inflation, and government policies.

While concrete figures, financial data or verifiable information underpin most of these influencing factors, there is another less tangible force that can sometimes sway markets in either direction.

Market sentiment refers to the overall prevailing mood of investors in a particular market or asset class, serving as a reflection of their collective belief about the direction in which markets or prices are headed.

Reading the room

Market sentiment is broadly categorised as optimistic (also known as risk-on or bullish), pessimistic (risk-off or bearish), or neutral.

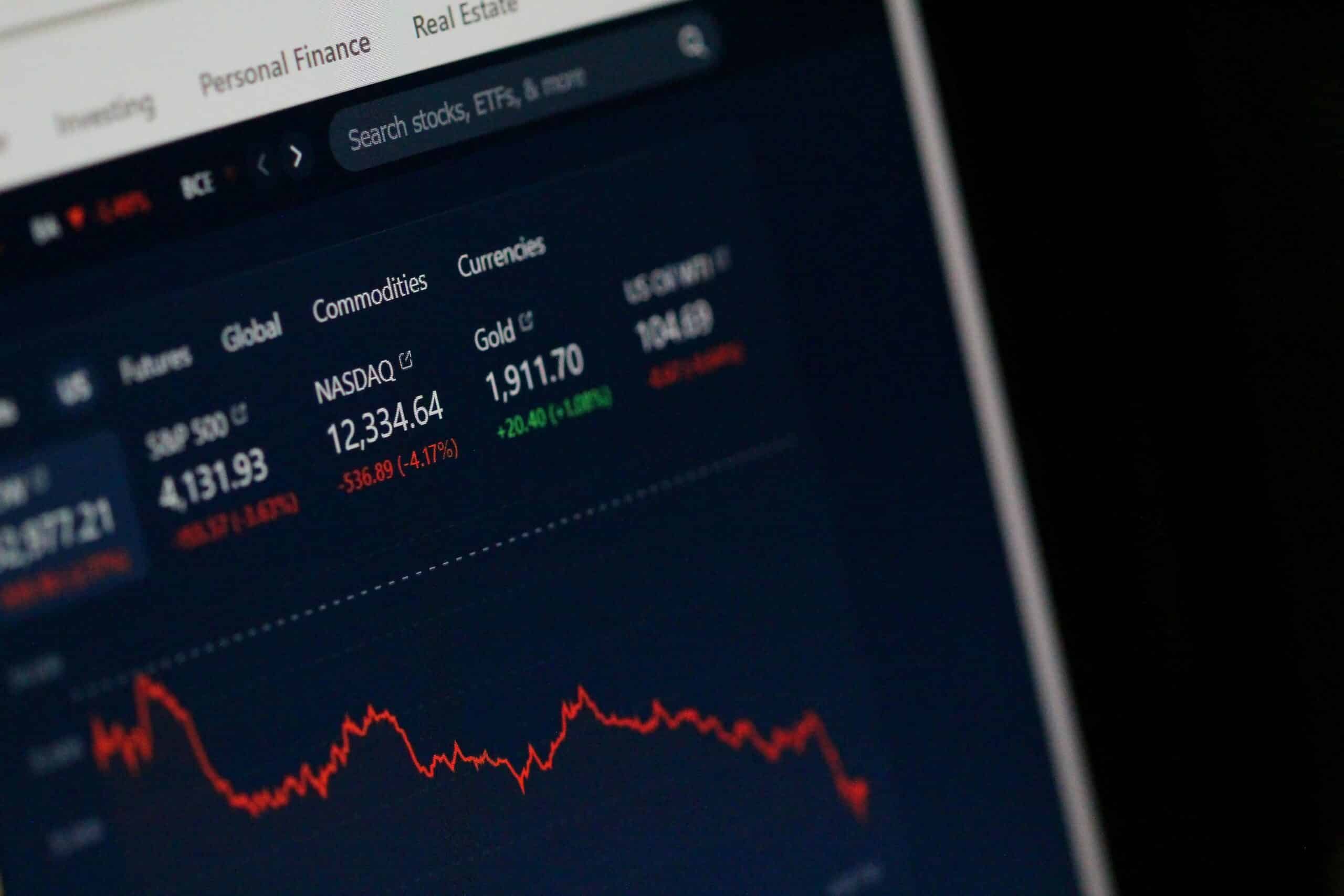

During periods of risk-off sentiment, investors typically take a cautious approach in financial markets, typically prioritising capital preservation over potentially higher returns. This situation typically leads to selling riskier assets like stocks and high-yield bonds, which can be volatile. The result is usually a drop in these asset prices.

A risk-off environment generally means a downturn in stock prices, which can negatively impact stock traders who are long, short sellers might benefit.

In a risk-off environment, investors tend to move their money towards safe-haven assets like gold, foreign currency like the US dollar, or government bonds, especially those from stable countries. As demand for safe-haven assets increases, prices typically rise.

During periods when risk-on sentiment prevails, investor appetite for riskier assets like stocks and high-yield bonds grows as their risk tolerance rises in the hunt for higher returns.

The bulls and the bears

Various factors influence market sentiment, with quantitive data such as economic indicators and corporate earnings used to formulate a bullish or bearish stance on markets or company stocks.

Strong indicators typically breed market confidence, with bullish sentiment typically supporting buying to boost asset prices.

In contrast, weak data can raise fears of a recession and trigger risk-off sentiment and a move to safe-haven assets. When sentiment turns bearish, it is usually indicative of an incoming correction. Identifying these shifts in sentiment can help investors avoid heavy losses.

Geopolitical events such as conflicts, political instability, trade wars and policy uncertainty can also increase the risks associated with investing in a regional market or specific asset classes. Investors typically express negative market sentiment in these instances, which can lead to investment outflows from unstable countries or flight from riskier assets like equities and government bonds.

These factors generally affect markets in predictable ways, allowing traders and investors to analyse news and financial markets to make informed decisions about how to respond or position portfolios to protect investments from downside risks or take advantage of potential market movements to potentially capitalise on the prevailing trends.

Herd mentality

However, there is also a less predictable aspect to market sentiment that can result in unexpected and unpredictable shifts in global markets.

Ultimately, humans are emotional beings who sometimes react irrationally to news or events in unpredictable ways due to the powerful influence of fear or bias. The resultant counter-intuitive or unexpected investor behaviour can amplify sentiment swings.

For example, positive news or rumours can lead to investor exuberance and excessive buying, which drives prices higher than fundamentals may justify, while bad news can send asset prices into a nosedive as fear and herd mentality drives en-mass selling.

Some investors use herd mentality to their advantage by taking a contrarian view of the broader market consensus. For instance, in overly bullish, especially where markets choose to ignore contradictory indicators, contrarian investors or traders might choose to short the market, betting that a correction is coming.

Using market sentiment to your advantage

Sentiment has an undeniable impact on markets but investors and traders should never rely solely on it when making investment decisions or formulating a trading strategy.

Risk sentiment can change quickly based on current news, emerging economic data, earnings reports or cautionary notices from listed companies.