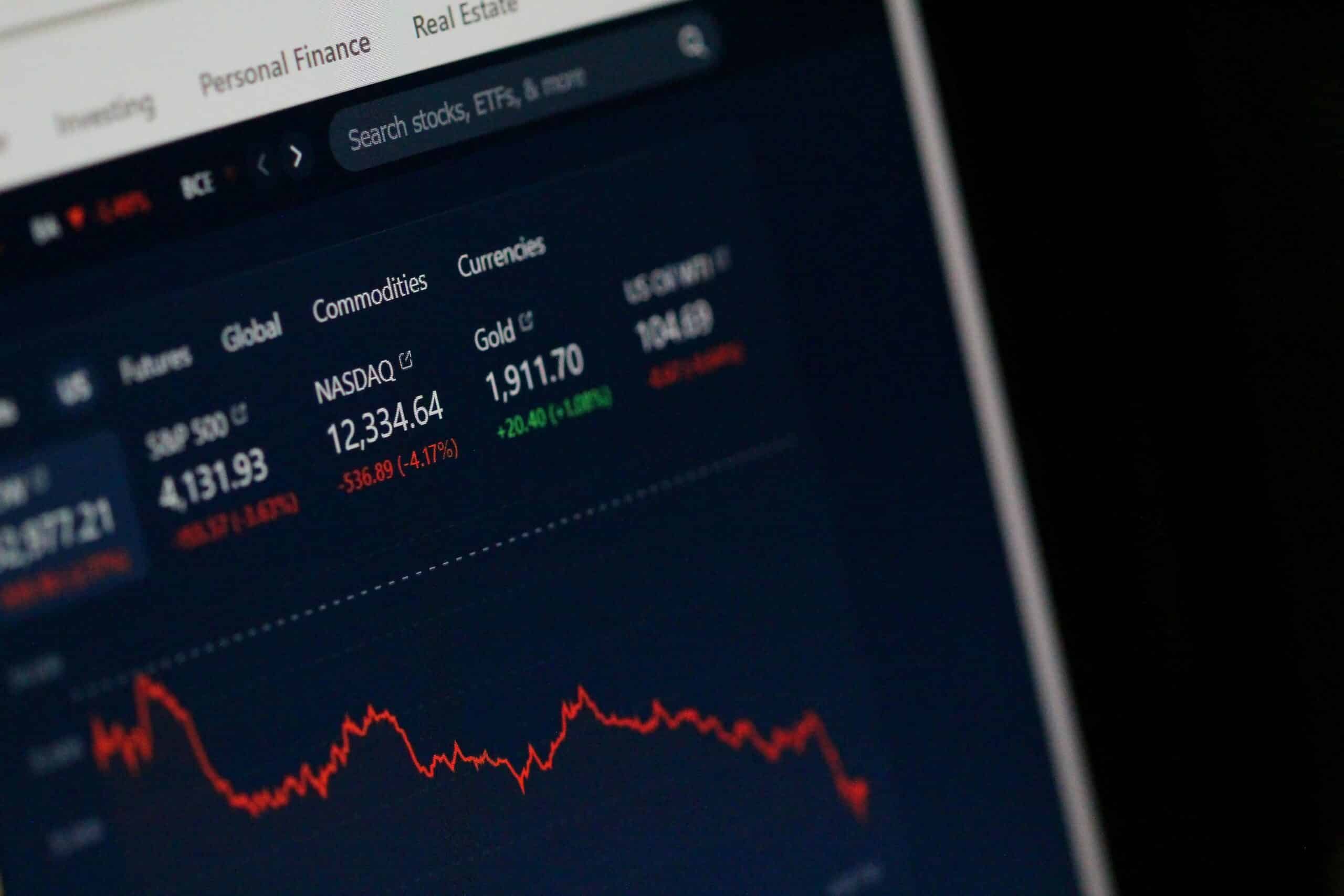

Momentum indicators help traders understand the potential direction and speed with which a particular stock price will likely change, which can help inform position trades or better understand the strength of price movements to realise a return.

Traders can analyse the speed at which a particular stock falls or rises by using momentum indicators. These technical indicators can help traders enter a trend at favourable prices as it gathers pace and ride the trend for potential gains.

Traders can confirm market or asset movements and their direction by changes in trading volumes and by using one of several technical indicators to get trade signals and confirm the trend.

Types of momentum indicators include:

Moving Average Convergence Divergence

Moving Average Convergence Divergence (MACD) is a momentum indicator that shows the relationship between the two moving averages and a signal line. It consists of the MACD line and the signal line. This indicator generates a buying signal when the MACD line crosses above the signal line, or a selling signal when it crosses below the signal line.

Relative Strength Index

Relative Strength Index (RSI) is an oscillator that measures the speed and change of price movements for a particular period. The indicator oscillates between zero and 100. When the RSI crosses above 50, it signals positive momentum. However, an RSI above 70 is generally considered overbought, suggesting a potential reversal. RSI readings that cross below 50 show negative and downward momentum, with values below 30 considered oversold, suggesting a potential buying opportunity.

Rate Of Change

The Rate Of Change (ROC) indicator is the speed at which a stock price changes over time. This indicator is expressed as a ratio between a change in one variable relative to the change in another.

A stock with high momentum has a positive ROC, whereas a low-momentum stock has a negative ROC and is likely to decline in value, which indicates a sell signal.

Parabolic Stop and Reverse

A Parabolic Stop and Reverse (SAR) indicator places a stop-loss level that adjusts dynamically based on price movements. When the price breaks above the SAR, it signals a potential uptrend, and when the price breaks below the SAR, it signals a potential downtrend.

Stochastics Oscillator

Traders use this momentum indicator to compare the closing prices of a stock over a particular period. It tracks the momentum and speed of the market and does not consider volume and price. Stochastics help identify the overbought and oversold zones, oscillating in the range of 0-100. Values above 80 denote the overbought zone and below 20 is the oversold zone.

Directional Movement System

The Directional Movement System group of indicators is used to help measure the momentum and the direction of price movements. The Directional Movement System consists of three elements:

- The Average Directional Index (ADX)

- The Minus Directional Indicator (-DI)

- The Plus Directional Indicator (+DI)

ADX values of 20 or higher indicate that the market is trending while any reading less than 20 indicates that the market is directionless or consolidated.

Momentum trading strategies

Traders can use a combination of indicators to inform their momentum trading strategies, helping them to decide when to deploy the most appropriate approach in response to prevailing market conditions.

Traders deploy a breakout trading strategy to buy a stock when it breaks above a resistance level or sell it when it breaks below a support level. The idea is to capture the momentum as the price moves in the direction of the breakout.

A pullback trading strategy focuses on buying a stock after it has experienced a temporary pullback from an uptrend, or selling it after a temporary rally in a downtrend. The assumption is that the underlying trend will resume, providing an opportunity to enter at a potentially lower price.

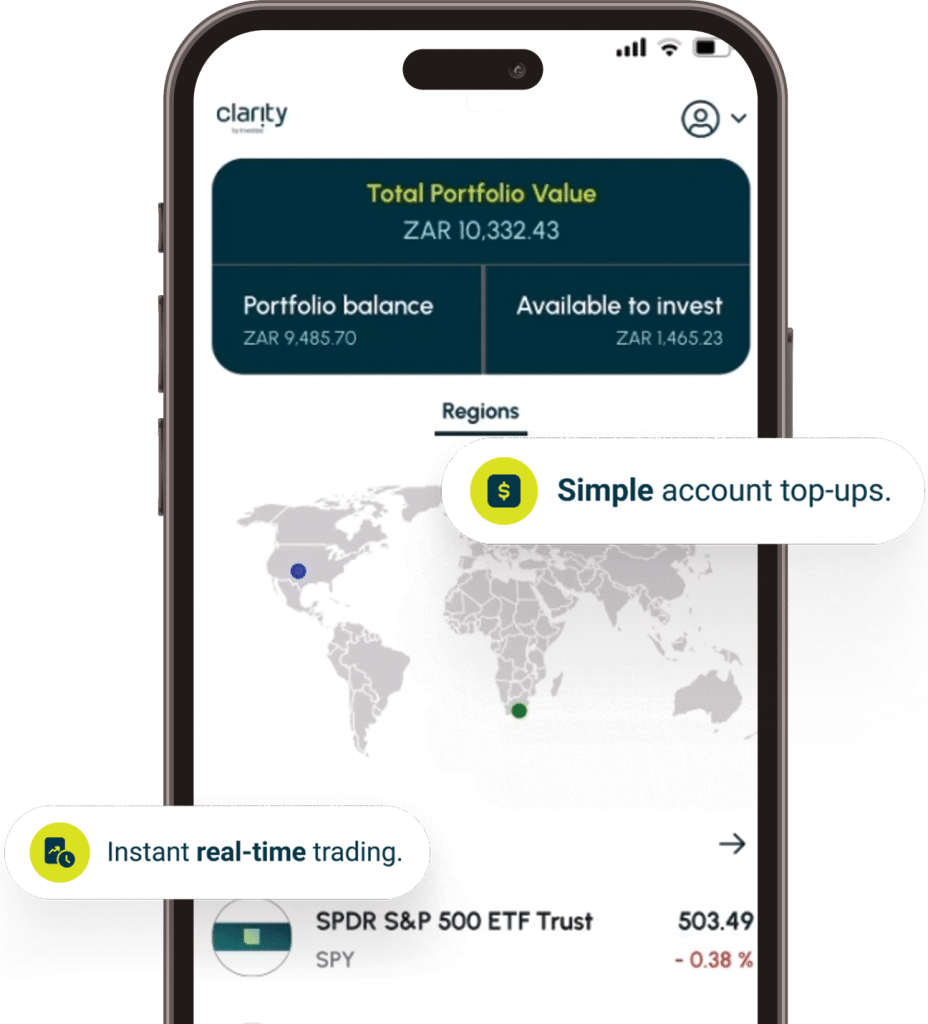

While these strategies and indicators are helpful tools to define and implement a trading strategy to capture your share of the market, it is important to use them in conjunction with other analysis and risk management techniques.

Momentum trading carries risks, and it is essential to have a solid understanding of the underlying principles and implement the appropriate risk management strategies.